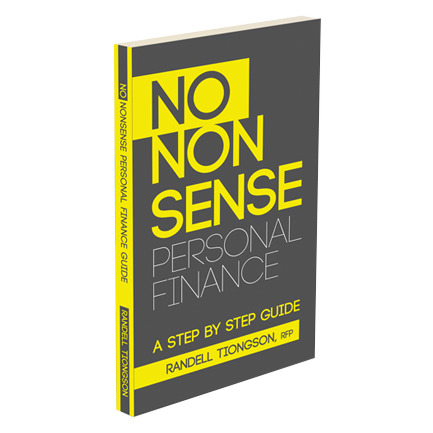

No Non-sense Personal Finance: A Step by Step Guide

Learn to reach financial stability in a few pages

The solutions to our financial problems are actually simple but they involve a process. Contrary to popular notion, there are no shortcuts to achieve a good financial life and future. Lasting solutions are those that are ingrained with a sound financial foundation that is rooted on the right behaviour coupled with the proper knowledge. A sound financial life arises from a process and with the blessings of the Lord, not those nonsense things like lucky charms, superstition, wealth attraction, and all other garbage so many foolishly believe in.

Money Manifesto:

Lessons in Personal Finance;

A hearty, personal 300 page book about finance that covers a wide spectrum of subjects which include: money management, investing, economics, and more. It blends the personal experiences of both the author and his peers and the lessons they've learned from them, as well as lessons and tips on how to better manage one's finances and secure one's future. It also seeks to encourage and inspire its readers to improve their lifestyle and make better choices.

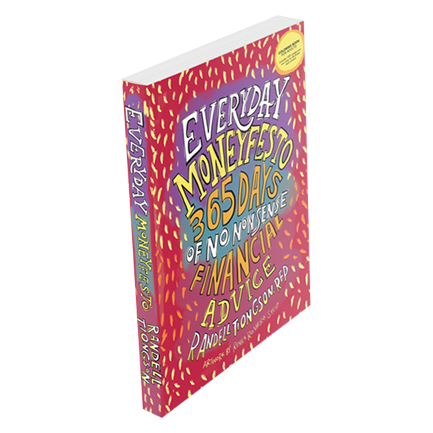

Everyday Moneyfesto:

365 Days of Financial Wisdom;

As a unique book that helps inspires and educates its readers daily, the Everyday Moneyfesto shares financial wisdom, day to day advice, and deep insights into the world of finance. It also contains artwork from Rinka Romero-Sycip which can be used as a creative output for those with a penchant for coloring. In addition, it also contains prime material from big personalities such as: Bo Sanchez, Efren Cruz, Chinkee Tan, Coney Reyes, Miriam Quiambao, Edric Mendoza, Dennis Sy, and more!