Top 8 Equity Fund Performances

By Randell Tiongson on November 5th, 2013The year is almost over and this has been a whirlwind of a year for the Philippine Stock Markets. The start of the year saw a tremendous surge of the market pushing the Philippine Stock Index beyond the 7000 mark. Towards the middle of the year, massive correction and decline was seen as foreign funds took profits but our market seems to be more resilient than ever. Some recovery was seen pushing the market up again and refusing to enter a bearish market. Our market has yet to go back to the 7000 mark but many analysts are confident we will be back to those levels sooner than later, perhaps early next year?

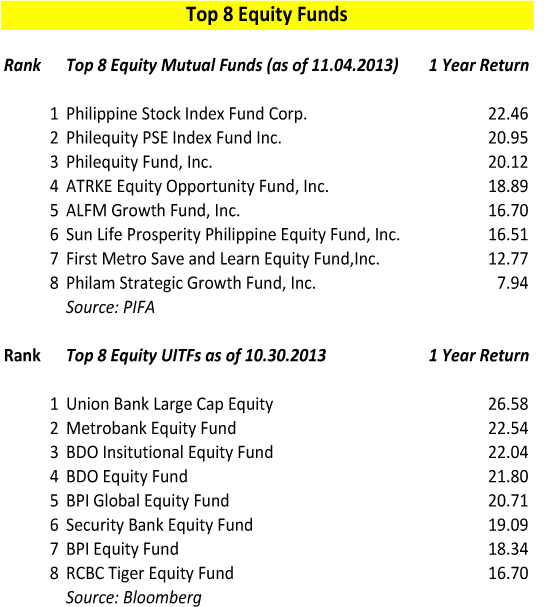

For those who invested in equity pooled funds like mutual funds or Unit Investment Trust Funds (UITF), it is good to know that there continues to be good returns although not as substantial as 2012. I have collated the 1 year returns of the top 8 equity funds, both mutual funds and UITFs. On the mutual funds side, the 2 index funds rose to be the top performers for the 1 year period lead by the Philippine Stock Index Fund and the Philequity PSE Index Fund. Customarily, managed funds outperforms the index, but that’s not the case for this 1 year period. On the other hand, some UITFs performed better than the index funds and 5 of those UITFs registered above 20% returns for 1 year led by Union Bank, Metro Bank and BDO and BPI. The UITF equity funds seems to be performing better than their mutual fund counterparts for the 1 year period.

Let me repost what I earlier said in an earlier post: “I need to caution readers, however, that returns are not the sole factor if selecting a fund. Aside from fees, it will be good to check on how volatile the funds are, experience of the fund manager and size of fund. Bigger funds are usually less volatile but may not have the best performance. Further, equity funds that are more diversified and having more variety in the fund is generally less risky.”

Mutual Funds are available through Mutual Funds Companies and are regulated by the SEC. UITFs are available through banks and are regulated by the BSP.

Thanks for sharing these Top 8 Equity Fund Performances. More success, Sir Randell.

Hi Randell,

Your article made me curious on how the equity investment linked funds performed over the same period. I have to underline that the returns in the investment linked funds are managed in such a way to optimize the risk adjusted return over a period of 5 years, but nevertheless I thought it was interesting to get the comparison.

Please see below the performance on the same period:

Unit-Linked Equity Funds Currency YOY (11/05/12 to 11/04/13)

AXA Chinese Tycoon Fund PHP 27.5%

AXA Philippine Global Advantage Fund USD 24.1%

Manulife Affluence Gold Peso Equity Fund PHP 23.5%

AXA Wealth Equity Fund PHP 21.9%

AXA Opportunity Fund PHP 21.4%

PruLink Equity Fund PHP 18.1%

Sunlife Equity Fund PHP 17.7%

Sunlife Growth Fund PHP 16.9%

Philam Peso Equity Fund PHP 9.7%

AXA Spanish American Legacy Fund PHP 9.4%

Philam Strategic Growth Fund PHP 6.8%

Of course I’m pleased with the results, but again like to stress that a point to point comparison is similar to describing the health of a patient based on one temperature reading. In AXA we therefor prefer to show the average performance over a high number of readings and we also show the highest and lowest performance to give our clients a feel of the possibilities.

Nevertheless I was also pleased to see that the returns of the Investment linked funds in the industry are well positioned compared to UITF’s and Mutual funds.

Kind regrads,

Rien

when is the right time to take profits from my uitf investment? is 10% profit of amount investment already a good move or i still have to wait until a bigger profit?