Master Class for Financial Advisors

By Randell Tiongson on July 1st, 2019

Financial advisory and sales are one of the most attractive professions today. However, financial advisors are subjected to many challenges that prevent them from achieving success in their chosen field.

If you are a financial advisor and you would would want to improve your craft, join my Master Class and be on your way to achieve greater heights with your profession and business.

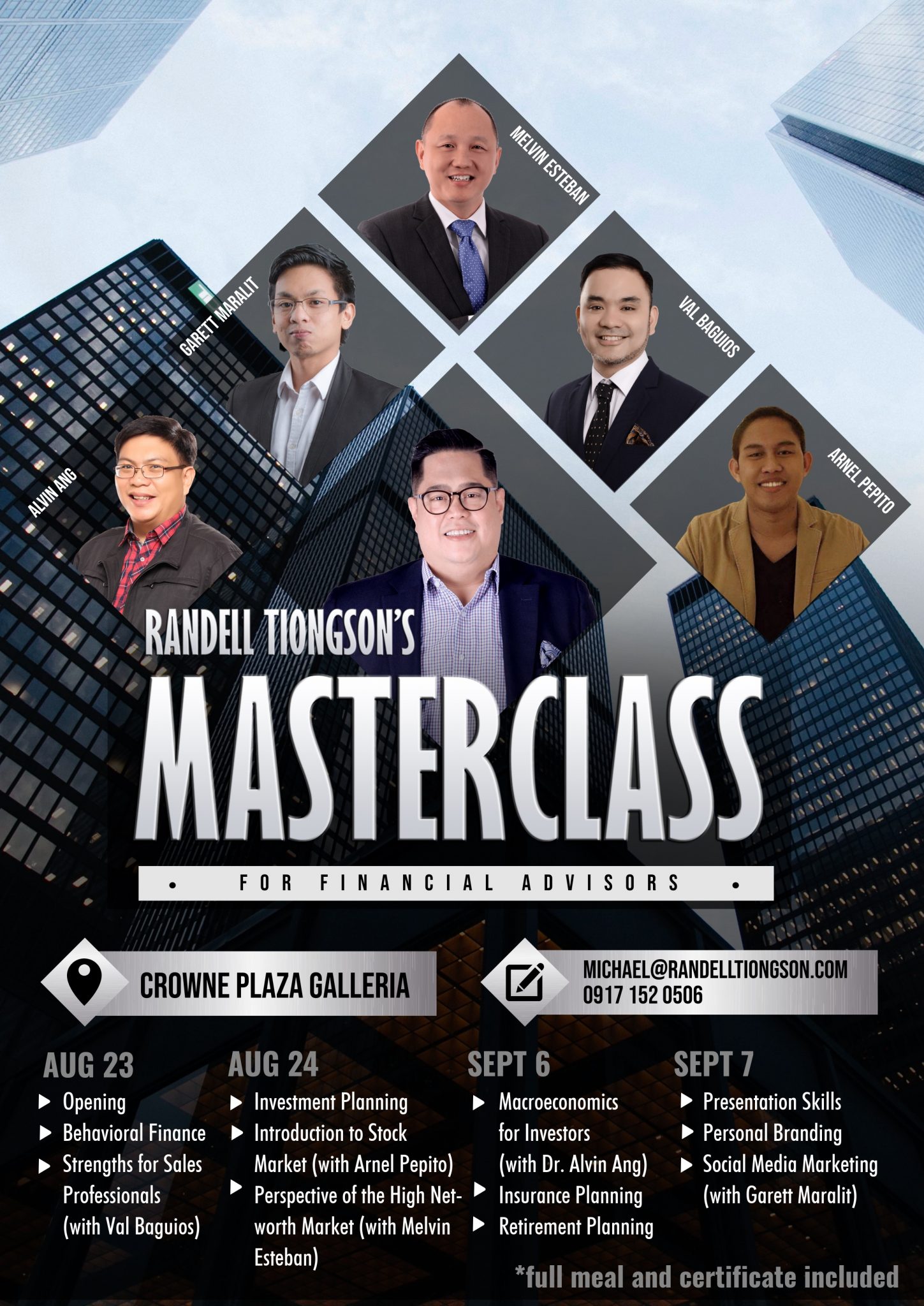

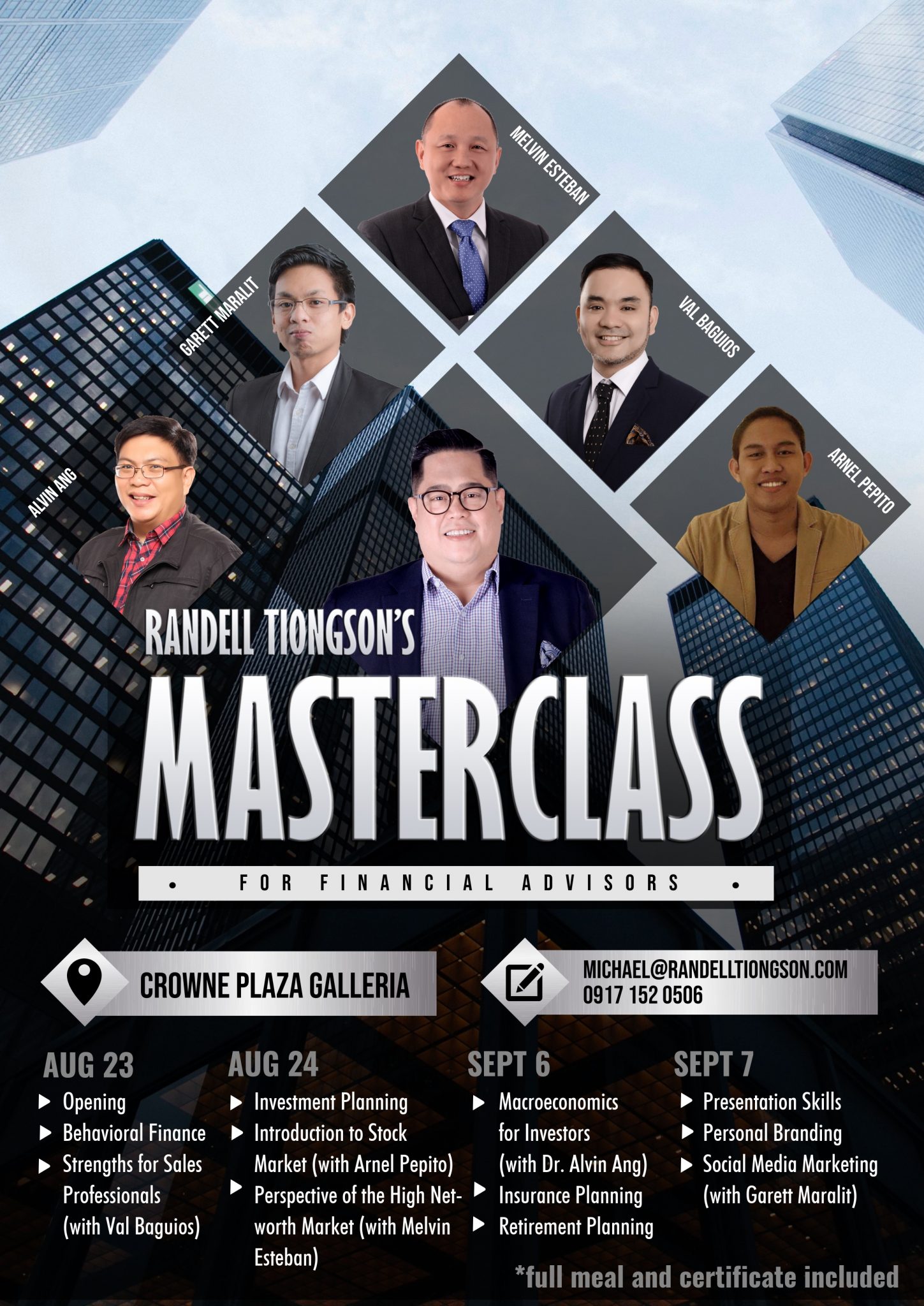

Randell Tiongson’s Master Class for Financial Advisors will feature experts who have proven track records:

Melvin Esteban is a well-respected wealth management practitioner who has over 2 decades of experience in the financial services industry. He has extensive corporate experience in insurance, wealth management and consultancy and also a regular lecturer at the Registered Financial Planner program. Melvin is a Fellow of the Life Management Institute (FLMI) with Distinction, an Associate with Financial Services Institute, a Registered Financial Planner with the Registered Financial Planning Institute, Ohio, and a Certified Financial Consultant by the Institute of Financial Consultants, Canada, with High Distinction.

Dr. Alvin Ang is a professor of economics at the Ateneo de Manila University. He is currently Director of Economic Research in the same university. He has a PhD in Applied Economics from Osaka University as a Japanese government scholar. He was a former economics professor at the University of Santo Tomas and was the former head of the Research Institute of UST. Not only is he a favorite professor my many, he is also a favorite speaker on economic matters in different government and corporate settings as well as a regular guest on tv and radio on the same topic. He is a regular columnist for the Business Mirror. He ss fondly called the “everyday economist” because he has makes complex topics easy to understand my many.

Val Baguios is a an IT practitioner but pivoted to become a strengths and executive coach. He is an International Coach Federation (ICF) certified coach and a Gallup-certified Strengths coach. Val has been featured in many institutions and programs where he makes people understand the value of coaching and empowering individuals to strategic, purposive and strengths-based endeavors through one on one coaching and people development.

Arnel Pepito is a full-time trader and portfolio manager participating in the Philippine Stock Exchange. Arnel is a stock market enthusiast and an investing/trading advocate. He has vast interests from trading currency, commodities, futures to global equities. He is also blogger and a no-nonsense investments advocate who is very passionate in sharing the opportunities in the stock market and other investment vehicles. He is the founder of Investambayan, a very active social group that provides stock market education. He is followed by over 10,000 people due to his passion to share his knowledge.

Garett Maralit is an engineer turned financial practitioner. He is the co-founder of The Bright Millenial, a Facebook group that currently has over 220,000 followers. Garett has been one of the most prolific and successful individuals to use and maximize the benefits of social media to benefit the financial advisory industry. With the barrage of pages and groups in the social media, Garett Maralit was able to distinguish his brand and continues to stand out in social media, particularly Facebook. His experience and exposure in the social media has propelled Garett to be one of the top advisors of his branch and now leading a robust group of young financial advisors.

Randell Tiongson is one of the Philippines’ most respected and followed personal finance coach. He is the cofounder of the Registered Financial Planner, a best-selling author, media practitioner and international speaker and a columnist. He has been influential in the development and growth of the financial planning industry and is a leading thought leader and influencer in personal finance. Randell has over 3 decades experience in the financial services industry and has experience in sales, marketing, training, consultancy and more. He is the person behind the most attended finance conferences such as iCON, Money Talks, Build Your Future. He has also sold over 100,000 finance books to date and has given over 1,000 talks and seminars over the years.

Randell Tiongson’s Master Class for Financial Advisors will run on August 23 & 24, 2019 and September 6 & 7, 2019 at the Crown Plaza, Robinsons Galleria from 9am to 5pm.

What can you experience in the Master Class for Financial Advisers?

August 23, 2019

The need for a better advisor

Behavioral Finance

Level Up Sales

Strengths for Sales Professionals (with Val Baguios)

August 24, 2019

Investment Planning

Introduction to Stock Market (with Arnel Pepito)

Perspective of the High Net-worth Market (with Melvin Esteban)

September 6, 2019

Macroeconomics for Investors (with Dr. Alvin Ang)

Insurance Planning

Retirement Planning

September 7, 2019

Presentation Skills

Personal Branding

Social Media Marketing (with Garett Maralit)

The learning investment is only P19,800.00 and it covers full meals, Gallup Strengths Finder test and a certificate.

*Special Group rate: P15,800 per participant, minimum of 5.

Here’s how you can participate:

- Deposit the amount to BDO 006440069496 or BPI 0249111309 under John Randell Tiongson.

- Email a photo or screenshot of the deposit slip or transfer advise to [email protected] and indicate the following:

- Full name and nickname

- Company represented

- Years in practice

This Master Class has only limited slots available and we expect it to be filled up soon.

See you at the Master Class for Financial Advisors!

The Essentiality of Investing on Knowledge

By Randell Tiongson on March 14th, 2016

‘If a man empties his purse into his head no man can take it from him. An investment in knowledge pays the best interest.’ – Benjamin Franklin

This is a longer version of the usual quote “An investment in knowledge…” The author expresses a straight forward saying, which means that there will be a great outcome if you start focusing on nurturing your intellectual being. You’ll gain a better understanding over some matters, and this is not something that anyone can take away from you.

This kind of investment is something that we tapped without noticing. But add a little consciousness to it and you’ll see its essentiality.

The essentiality today

In a recent study, 60 % of the Philippine population would be people of ages 30 and below, a portion of which are the millennials. From my past blog about “Personal Finance for Millennials,” 75% of the latter spends more on experience rather than material goods. They have this hardworking, motivated, “everything in an instant” attitude, that gives them a fast pace of knowing things.

Experiences correlate with knowledge as these two are the foundation of wisdom. It is not enough if you just know it without doing it, as the same goes to if you just do it and don’t learn from it.

But, millennial or not, all of us need to keep up with the changes and learn as much as we can.

Where to find them

The technological or digital age is our period where information is within grasp. The least we can do is to make the most out of it. With the aid of a powerful tool called the internet, we know that searching for what we need now can be done easily.

Whether it is searching for a nearby library, a current event, a technological advancement, socialize to learn, etc. it’s just one click away.

It’s a great way to start on consciously investing on knowledge for its compact-ability and multiple platform-compatibility. It gives you an experience where you’ll gain knowledge at ease. This article too, is a contributor to your intellect as it gives you an insight on the essentiality of the subject matter.

But, that is just one of the sources.

One of the most effective way of consciously finding an investment opportunity in both intellect and business setting is by attending business seminars and conferences, more specifically, in the field of finance. The eminent and selfless transfer of knowledge from one body to a numerous number of persons is a great opportunity to be a part of. The people who may came from different parts of the country, yet unifies them in a single interest that gives them a sense of belongingness. Those are some things that I have observed from numerous seminars and conferences that I have been on.

The bottom-line

Our brain works in many ways, and what we need is to give input for it to make it work with ease. Knowledge is an essential investment in your intellectual well-being. It takes you to a point of view with deeper understanding of a subject.

Also, it takes out the fear of the unknown. It brightens the grey areas of your thoughts and gives you a confidence boost on what you want to endeavor, especially in business. It can be really tricky for a person who doesn’t know much how business works rather than the principle of spending money to earn money.

Being financially knowledgeable is a great way for you to know how to intelligently cope up with the ups and downs of daily business operation; Trends that you can see fit to venture in to, in order to make your money grow while spending less; And how to make your money work for you.

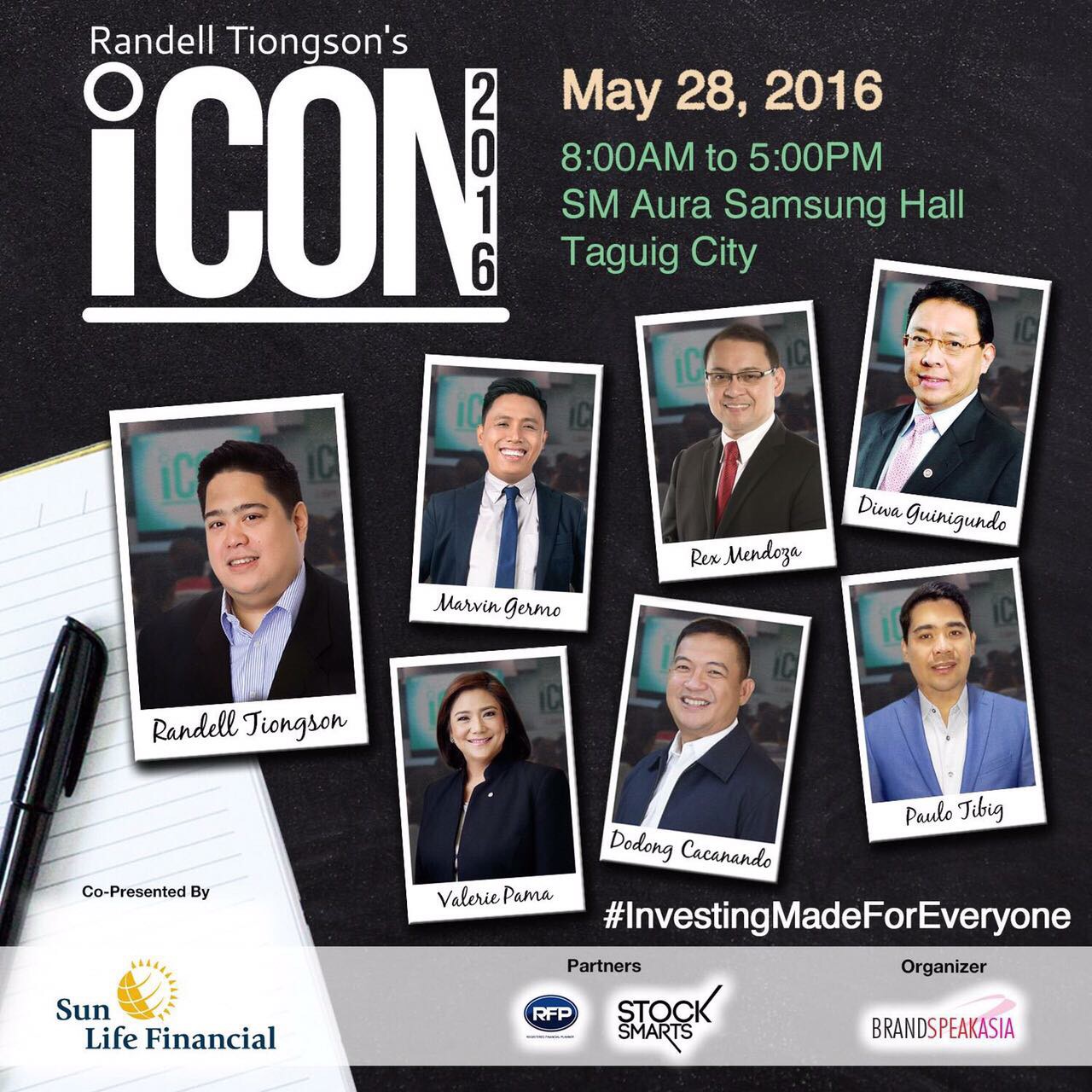

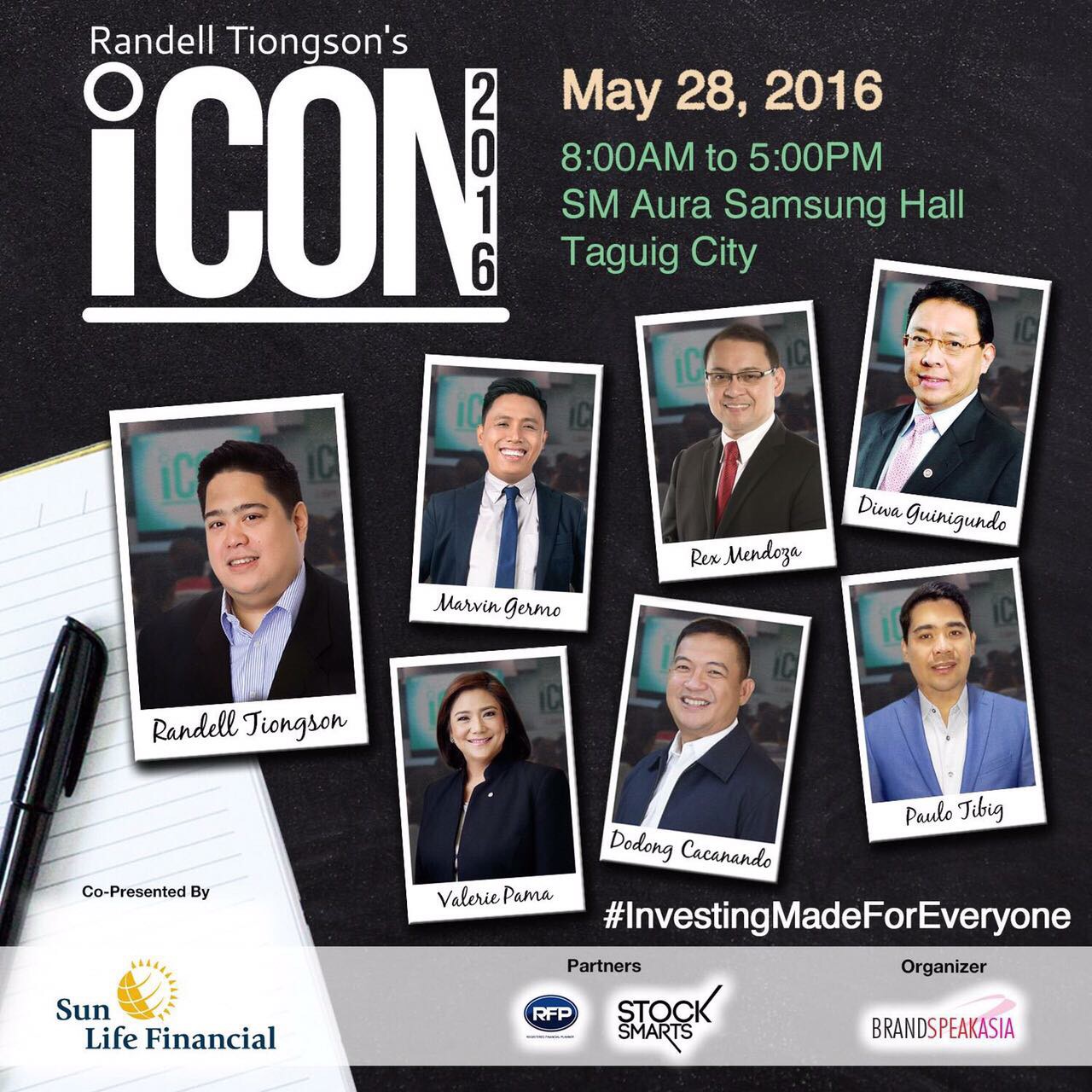

You can start investing in knowledge now by attending the fourth install of my Investment conference dubbed as #iCon 2016 this coming May 28, 2016 at the SM Aura Samsung Hall in Taguig City.

Take part of this iCON-ic event as with a bigger innovation, we have gathered a stronger group of local finance authorities in the country to talk about basic finance and how the recent innovation affected the economy through Marvin Germo, one of the most passionate personal finance experts in the Philippines; Diwa Guinigundo, an economist and Deputy Governor of the Bangko Sentral ng Pilipinas; Paulo Tibig, one of the most sought after professional speakers in the entrepreneurship community; Rex Mendoza, Founder and Managing Director of Rampver Financials and the most dynamic financial speakers in the Philippines; Jose Feron “Dodong” Cacanando, a businessman who owns Moriah Farms, Inc. and Karmel HA-Moriyah, Inc. and a truly inspiring business speaker; Valerie Pama, the President of Sun Life Asset Management, one of the country’s biggest mutual funds, and yours truly.

For transmission confirmation or questions contact Deniece Pineda at (+632) 750-6510 or 0926-691-0126 or at [email protected].

REGISTER NOW AT bit.ly/GO_ICON2016

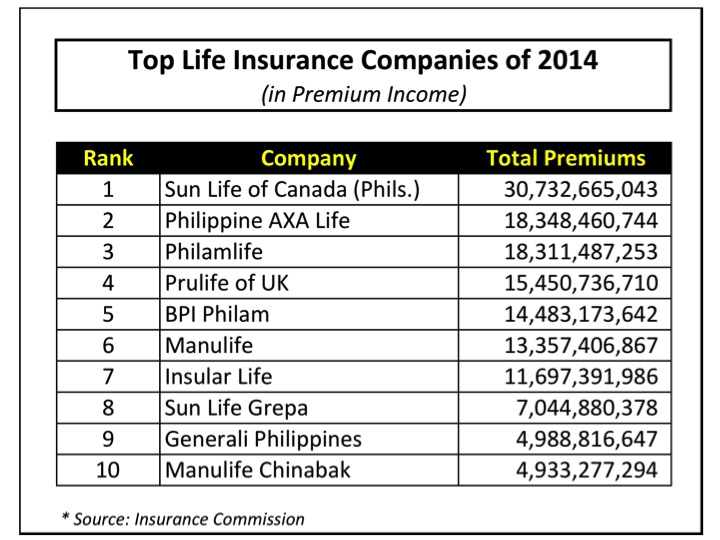

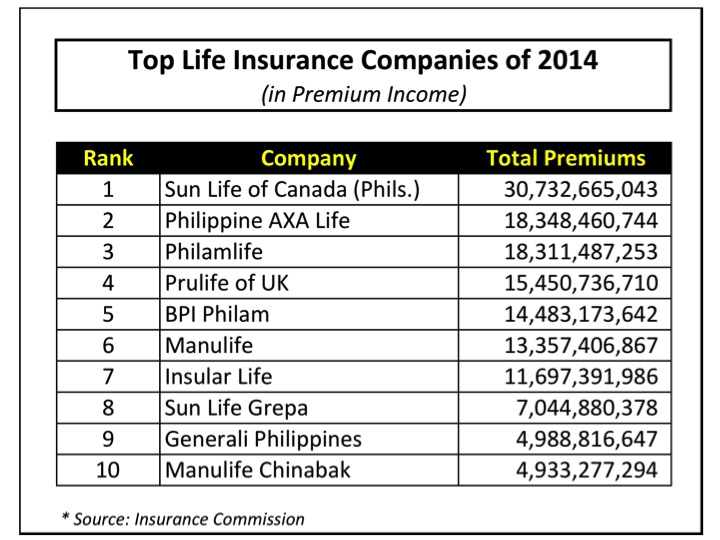

The Top Life Insurance Companies of 2014 in Premiums

By Randell Tiongson on April 7th, 2015

And the list of the Philippines’ top 10 life insurance companies in 2014 is released! Once again, Sun Life dominates the rankings for the 4th year in a row. With its increase in 2014 of a little over a billion pesos in total premiums, Sun Life proves to be among the most stable insurance companies. Apart from maintaining its prime spot, Sun Life has surpassed itself by creating a wider gap between the second top company, with a difference of little over twelve billion pesos in total premiums.

Having been in the insurance industry for over a century, Sun Life has been able to create products and services that are able to meet all the needs of people. Moreover this company is known for their relevant and significant marketing strategies, which have given them an edge in this industry, allowing the company to hold on tightly to that top spot.

While the top spot still remains the same, there has been a shift among the 2nd and 3rd spots. The year 2013 saw Philam Life and AXA Philippines at the 2nd and 3rd spot, respectively, with a difference of over a billion in total premiums. However this was not the case for 2014. AXA Philippines has bumped Philam Life off the 2nd spot and reclaimed the position they had held for many years, prior to 2013. With their aggressive and revolutionary marketing strategies, AXA Philippines proves, once more, why they deserve to be part of the top three.

Falling to the 3rd spot with just a small difference of thirty million in total premiums, the total premiums of Philam Life from America have dropped slightly from its phenomenal PhP 19 billion in 2013 to PhP 18 billion in 2014. Nonetheless, their performance is still top rate and noteworthy.

In the 4th spot is Prulife UK, which maintained its ranking of number 4. Although the total premiums of PruLife UK have decreased by PhP 3 billion from 2013, Prulife UK is still able to hold to its prime position in the rankings due to their strong marketing arm.

2014 has also seen a slight restructure in the rankings of BPI-Philam and ManuLife. Though they still performed well this year, ManuLife has fallen down a spot to the 6th ranking. With a little over a billion difference in total premiums, ManuLife is just a little behind BPI-Philam. Climbing to the 5th spot would be BPI-Philam. With its strong infrastructure and fantastic productivity, these two companies have been neck to neck, as seen in the rankings. SunLife Grepa’s performance has slightly gone down as seen in the rankings by being in the 8th spot. However the largest local insurance company improves and is seen to be going up the rankings by claiming the 7th spot.

Manulife Chinabank has also improved and is seen to have gone up the rankings to the 9th spot. However the 10th spot is now claimed by ManuLife Chinabak. Formerly held by PNB Life, the total premiums of PNB Life has gone down from its 6 billion in 2013 to 4 billion in 2014. A round of applause for ManuLife Chinabank though, for entering the top ranks.

Taking a look at the whole picture, 2014 produced premium income of P157,831,673,089. While this number is smaller than 2013’s total premium income of P170,280,660,057, it shows that there is stiff competition in the insurance industry and was brought about by lower single pay premiums. Ultimately, these numbers indicate that Filipinos are becoming smarter about their money, with more people seeing the value of setting some aside for their long-term financial security.

*Data from the Insurance Commission.

Complete rankings of all other categories (net income, net worth, assets, etc.) can be found at the Insurance Commission website or click HERE