2014 Outlook, part 6

By Randell Tiongson on January 14th, 2014

It is always a pleasure to present the views of one of the persons I admire a lot, a former colleague and now the CEO of the country’s largest life insurance company, Riza Gervasio Mantaring. A marathon runner, Riza’s disciplined approach in life helped her propel Sun Life to the top spot. I also admire Ms. Mantaring’s passion to help improve the nation’s financial literacy through many endeavors.

The 2014 Outlook of Riza Mantaring

2013 was the proverbial “start with a bang, end with a whimper” year. While fundamentals in the Philippines remained solid, changes in the external environment dragged the market down so that we basically ended the year back where we started.

So as we start 2014, to what do we have to look forward?

The first half of the year is likely to be volatile as the US winds down its economic stimulus program given its improving economy. Performance of its equity markets in 2013 has been stellar, reflecting the outflow of funds from developing economies back to the more developed markets.

Inflation may creep upwards, possibly curbing spending which has been driving our economy. In terms of public spending, government rehabilitation efforts in quake and typhoon-hit areas may somewhat offset the withdrawal of the PDAF and DAP, and hopefully PPP projects finally get underway at the pace necessary to sustain growth.

With an expectation of higher inflation, we may see local bond rates continue to creep up. Likewise, with a weaker earnings growth expectation from the banking sector, we are anticipating lower aggregate earnings growth for the market.

Still, despite a possibly volatile first half of 2014, the second half of the year should be more positive as we get better indicators on company earnings growth and the progress of government infrastructure spending. Longer term, the Philippines remains a favored destination and is forecast to continue its rapid growth over the next few years.

As to where the market will end? We expect a base scenario of 6500 for the Phisix, possibly reaching 6800. Remember, though, that the best time to buy is when the news is negative, not when it is positive!

Riza Mantaring is the President & CEO of the Sun Life Financial group of companies in the Philippines, and a member of its various boards.She started out in Information Technology and took on various roles through her 20+ years at Sun Life before becoming CEO.

Riza Mantaring is the President & CEO of the Sun Life Financial group of companies in the Philippines, and a member of its various boards.She started out in Information Technology and took on various roles through her 20+ years at Sun Life before becoming CEO.

Riza is a member of the Sun Life Asia Leadership Team. She has also participated in various international special projects and teams such as the task force for worldwide restructuring of the company, the task force for business processes, and special teams for Mergers & Acquisitions.

In 2010, on the occasion of the 100th anniversary of the University of the Philippines College of Engineering, she was selected one of the 100 Most Outstanding Alumni of the past century. In 2011, she was named by Moneysense Magazine one of the 12 Most Influential in Personal Finance, and became a recipient of the 2011 CEO EXCEL award given by the International Association of Business Communicators. Riza was recognized for bold and innovative programs and harnessing the power of communication to implement these programs, including the multi-awarded and pioneering “It’s Time!” financial literacy advocacy.

Riza graduated with a B.S. Electrical Engineering degree (cum laude) from the University of the Philippines, and an M.S. Computer Science from the State University of New York at Albany. She has also attended numerous executive development programs conducted by Harvard University, The Wharton School, Duke University, Oxford University, Asian Institute of Management, and The Niagara Institute. She is a Fellow of the Life Management Institute (with distinction).

She has been a board director of the Philippine Life Insurance Association since 2011 and is currently its Treasurer, and served as a board director of the Philippine Federation of Pre-need Companies from 2006-2008.

The Top Life Insurance Companies of 2012

By Randell Tiongson on June 11th, 2013

The Insurance Commission recently released the top Life Insurance Companies according to Total Premium Income as of December 31, 2012. There were a lot changes in the rankings from 2011, particularly in the top 5 rank.

Canadian insurer Sun Life Retains it’s number 1 position, a position it held since last year when they wrestled it from American insurance giant Philam Life. What is interesting to note is not only did they retain their ranking, the gap between the first and the second ranked company widened by a huge margin. In 2011, Sun Life surpassed Philam Life by a mere 300 Million by year end. By contrast, Sun Life’s difference from the runner-up in 2012 was a whopping 5 Billion Pesos with an astounding 44% growth from their 2011 numbers. It seems that Sun Life has been very productive and their various initiatives was bearing fruit, obviously — something her competitors are really seriously looking at for sure.

Coming in at 2nd place is the U.K. insurer Pru Life who had an astonishing growth and a jump of 2 notches from 4th in 2011 to 2nd in 2012. Last year was definitely a banner year for Pru Life who I noticed have been very active in its recruitment of more agents, among other initiatives. Moving 2 notches in the top 5 rank is no easy feat but Prulife of UK goes ahead of Philam Life who slips from number 2 in 2011 to number 3 in 2012. Prulife UK registered a huge growth of 57% from its previous year’s numbers which was enough to overtake Philam, albeit by a narrow margin of about 300 Million Pesos. Philam Life registered a growth of 13% from its 2011 premium base.

French insurer and one of the country’s pioneer in Bancassurance, Philippine AXA slips from it’s 2011 rank of number 3 to the 4th largest insurer by 2012 with a very respectable 23% growth in premiums from 2011 to 2012. Coming at the 5th place is BPI-Philam, the Bancassurance partnership between BPI and Philamlife who overtakes Insular Life who lands at the 6th spot. BPI Philam registered an incredible 78% growth from its 2011 numbers and was 800 Million Pesos away from Philippine AXA’s 4th rank. Insular Life delivered good numbers in 2012 with a growth of 23% from its previous year’s premium base.

Canadian insurer and the 2nd oldest life insurer in the Philippines Manulife and the Bancassarance organization Sun Life Grepa retains its 2011 rankings at 7th and 8th respectively. Both organizations also registered good growth in 2012.

Manulife Chinabank and PNB Life, both Bancassurance dominated organizations are in the top 10 ranks at number 9 and 10 respectively, also registering good growth numbers.

Cocolife and Generali Philippines slips out of the top 10 rankings by the end of 2012.

Some interesting facts:

1) 2 out of the top 5 insurers are predominantly Bancassurance organizations. Simply put, Bancassurance is an organization that can sell insurance products to the bank clients and are co-owned by an insurance company and a bank.

2) 5 out of the top 10 insurers are predominantly Bancassurance Organizations.

3) 3 companies in the top 10 are actually subsidiaries of 3 other companies in the roster.

4) Only 1 Filipino insurance companies makes it to the top 10, Insular Life making them the largest Filipino insurance company.

5) Total Premiums generated by all Life Insurance companies totaled to P119,454,550,174

Congratulations to all the Life Insurance companies. My prayer is that more and more Filipinos understand the benefits of life insurance and be protected from life’s uncertainties.

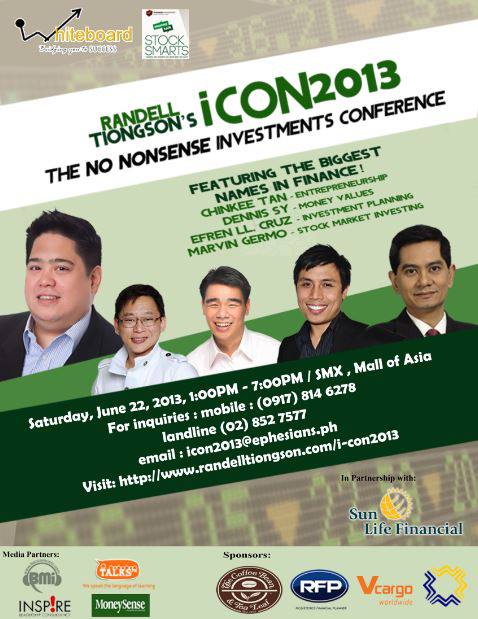

Students, attend iCon 2013 for FREE!

By Randell Tiongson on May 24th, 2013

Great news to all students who want to have a good financial future… you can now have a chance to attend iCon 2013: The No Nonsense Investments Conference for FREE!

Sun Life Financial is pleased to announce that they will give free  spots to selected students for a simple blog / essay writing contest.

spots to selected students for a simple blog / essay writing contest.

Here are the mechanics:

1) Open to Students only – High School, College and Post-Graduate students. You must show proof that you are a student by showing your School I.D. upon claiming your ticket.

2) Entry is via a blog or an essay posted in Facebook with two (2) topics/theme to choose from: “How can a student contribute to the national economy?” or “Why do students need to learn investing?”. A brief mention about iCon 2013 will be appreciated but not necessary.

3) Blogs or essays should be a minimum of 300 words, no maximum.

4) Blogs or essays should be posted between May 24 to June 9, 2013. Announcement of selected winners will be done via e-mail by June 12, 2013.

5) Winners can pick up their tickets at Sun Life located at the 6th Floor, Sun Life Center, Bonifacio Global City, Taguig c/o Karen or Dave. 2 tickets per winning entry.

6) Participants should like the Twitter of Sunlife (@SunLifePH)

7) Please advise us if you have posted your blog or essay by sending a link to [email protected] and [email protected]

* Selected blogs / essays maybe featured in www.randelltiongson.com and www.marvingermo.com or used by Sun Life for posting.

A lot of tickets are ready for those who want to join. Sali na!

Riza Mantaring is the President & CEO of the Sun Life Financial group of companies in the Philippines, and a member of its various boards.She started out in Information Technology and took on various roles through her 20+ years at Sun Life before becoming CEO.

Riza Mantaring is the President & CEO of the Sun Life Financial group of companies in the Philippines, and a member of its various boards.She started out in Information Technology and took on various roles through her 20+ years at Sun Life before becoming CEO.