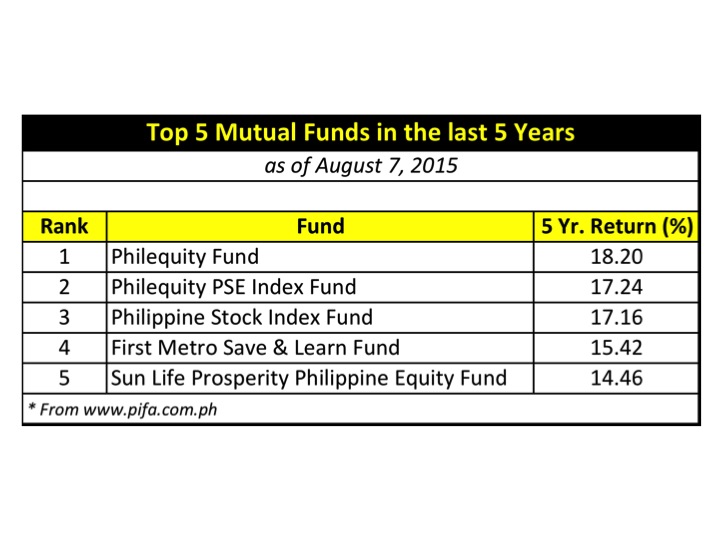

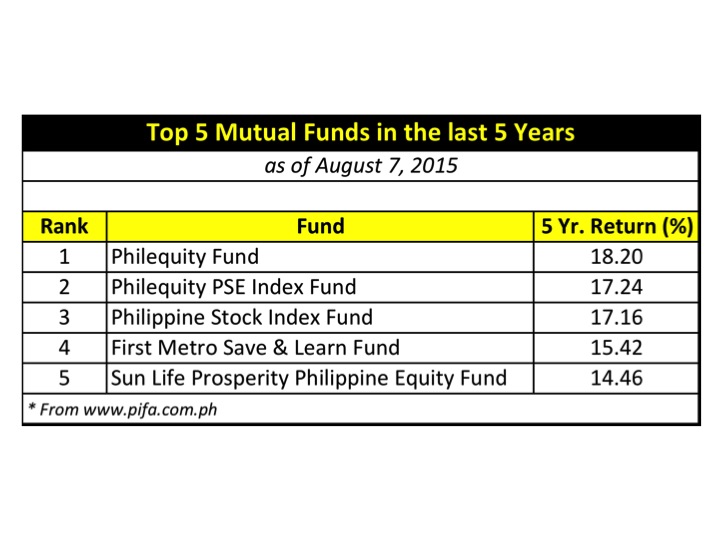

Top 5 mutual funds in the last 5 years

By Randell Tiongson on August 10th, 2015

There has been a lot of anxiety with what’s happening in the equities market. External forces have affected the local bourse and many investors are jittery. China, Greece and a slowing down of the economy has largely contributed to some declines lately.

The equities market are behaving the way it is supposed to behave, it goes up and down and it is largely sentiment driven. How about mutual funds? Are the fund managers doing their jobs in ensuring growth in their funds despite the volatility?

I recently checked out how the mutual funds are doing and I am happy to note that while the short term gains are very minimal, even losses for some funds, many funds are doing admirably when you look at them from a long term perspective… say 5 years. I have always subscribed to the belief that investing in the stock market is more about time and less about timing — time in the market is better than timing the market. Of course many traders will disagree but my purpose of going into the equities market has always been from an investors perspective and not of a trader.

When investing in pooled funds like mutual funds or UITF, it is best that you do so with a long term perspective — the longer you stay, the better it is! I recommend that you stay invested in your funds for as long as you can, and you only redeem them when you have already hit your objective. It is always best to know what your investment objectives are, as well as your time frame and risk tolerance. Once you have established them and invested your money, don’t react too much with how the market moves and always view your investments from a long term perspective. It will make you less jittery and it will keep you sane, trust me!

Below is a summary of the top 5 mutual funds in the last 5 years. Always remember, however, that past performance is not an indication of future performance — today’s top performer can be tomorrow’s laggard. A strategy I use is peso cost averaging — I invest in a monthly basis regardless of where the market is. But, whenever the market dips and I have investible funds, I try to buy more. It may not be the best strategy but it is a strategy that works for me. Of course, always remember to diversify your investments.

Happy investing!

15 Reasons why Philippine Stocks are Down, part 2

By Randell Tiongson on June 5th, 2013

Stock Market blood bath… what happened? My colleague and friend Marvin Germo wrote 15 reasons why. He posted the first 5 reasons in his blog, click HERE.

Stock Market blood bath… what happened? My colleague and friend Marvin Germo wrote 15 reasons why. He posted the first 5 reasons in his blog, click HERE.

Here are the next 5 reasons.

6. Technicals, our market broke 3 support levels including a very strong 100 day moving average. The breakdown portrays a strong level of selling strong enough to overwhelm all the buyers in the market at a certain time. The breakdown points that the next possible support level could be the 200 day moving average around the 6,000 – 6,100 area.

7. Massive Foreign Selling, as great there have been a sudden surge of Filipino investors as of late, a large amount of our market is still dominated by “hot money.” Foreign money that could easily be pulled out anytime, like what we are experiencing now as foreigners continue to sell down and take profit.

8. GDP Announcement, this is a classic “sell on news” move that investors pulled off! I personally believe that regardless of what the GDP announcement was, either good or bad people who have sold and would have used the GDP as a trigger for selling. Also our economy follows and trails the market by 9-12 months, meaning 7.8% gained by the market has already been factored in and is expected.

9. Panic Selling, most investors that bought at 7,300 ++ sold and cut losses after the market dropped below 7,000. As panic is a greater motivator than excited optimism, it’s easier for stocks to accelerate downward than for it to push upward.

10. Expensive Market, a lot of foreign fund managers regard our market as to be already expensive as compared to other markets. I may not agree with them as they don’t actually see the value of what our market has but you can’t blame them if they are there to buy cheap and sell when it gets expensive and to comeback again once things get cheap again.

Catch the next 5 reasons at www.marvingermo.com

Learn how to properly invest at iCon 2013: The No Nonsense Investments Conference

Stocks on a high

By Randell Tiongson on September 15th, 2010

The Philippine Stock Exchange Index (PSEi) breached the 4,000 mark when it peaked at 4,011.27 yesterday (Sept. 14, 2010) and closing at 3,968.29. At the beginning of this month, the index was at about 3,500 — that is indeed a very fast rise.

While I am personally happy that the market is moving north, the rise is a bit alarming. Many are saying that we are fundamentally sound, yet many are also saying it’s a bubble. Many investors are anxious as to what direction the market will head to.

While money can be made in the short-term, equity investing is still a long-term game for my preference. It’s still all about investment objectives, risk tolerance and time frame. My 2 cents.