Here’s How You Can Spot a Good Real Estate Deal in the Philippines

By Randell Tiongson on October 23rd, 2017

Every great investment starts with a great deal. Investors looking to start their real estate portfolio or even a bachelor planning to buy his first condominium unit must learn how to spot a great deal to make sure that their hard-earned money will turn into a valuable investment.

Here are some tips to remember if you want to spot a good real estate deal.

It’s a numbers game.

According to real estate blogger Brandon Turner, property hunters have to understand that snapping up good deals is largely a numbers game. You have to check out tons of listings in a specific area and narrow the leads down according to your preference.

For instance, if you are looking for a good deal in Mandaluyong, try to determine your own pre-qualifications. Should the property be near major throughways? Should it be below PHP 2 million? Should you consider foreclosed properties?

Once you have narrowed your choices, you have to analyze the value of the properties. Which among them do you think would appreciate in a reasonable amount of time and for what reasons?

Location, location, location!

Getting a good real estate deal all boils down to the location of the property. This does not necessarily mean that it should be at the heart of a business district or even along its peripheries. After all, location is also about connectivity and accessibility.

The key is to identify areas where it is easy to travel to and from major places of interest. For example, if you want a property that is accessible from Metro Manila, then you should consider scouring nearby provinces where costs are lower and there are plenty of options.

Always check out deals in these lower-priced markets as they possess potential returns especially when space demands in city centers become too saturated, pushing home seekers to look for alternative locations.

Why it’s wise to invest in foreclosed properties

Great deals may sometimes come in unexpected forms—in this case, in foreclosed properties. According to MyProperty.ph, a foreclosed property is a good money-saving option for its below-market-value price. The reason foreclosed properties have relatively low selling price is that banks are often swift in disposing these assets. You can expect them, therefore, to offer surprising discounts.

There are a few things you need to consider, however, as not all foreclosures are worth the money. First, inspect the condition of the property. Does it need a lot of repairs? Where is it located? Can you flip the property to make it marketable again? Additionally, you also have to know the terms in which the bank would sell the said property.

Try searching social media for leads.

Most people are now on Facebook, so it is easier to connect to potential property buyers. Indeed, some of the greatest deals can already be found via social media. You may not land the perfect deal at first try, but posts by individuals looking to sell their properties or marketing campaigns of real estate listing services would definitely give you an idea where to look further.

Consult listing sites.

There are a lot of listing sites out there that let sellers connect easily to potential property buyers. MyProperty.ph and Lamudi.ph are some of these listing sites that provide property owners with a platform where they can reach their prospective buyers.

Since these listing sites have their own gatekeeping system, the deals posted on the platform are all legitimate. It is a matter now of analyzing the merits and risks of acquiring a particular property viewed on the platform.

Should properties be at their prime condition?

It was already mentioned that when looking for foreclosed properties, the quality of the asset must be checked. In some cases, you might find diamonds in the rough that just need a little bit of flipping to turn into a true gem.

However, there are still considerations to ponder on such as location, accessibility, and price tag. If the slightly debilitated property is in a major city, check if it has an attractive neighborhood. You should also make an effort to see if the location is easily accessible. Regarding the price tag, you would have to discuss with the seller and bargain if you must.

Early birds get the best deals.

If you spot a listing you believe has potential, you better grab it quickly before the demand swells together with the selling price. More often than not, the one who calls and locks in the property first gets the ideal price.

In times when the seller already entertains multiple buyers, you should still act fast. Your offer must meet or even exceed the seller’s expectation of the value of the property for you to emerge victorious.

Do your research.

To land a great deal, it pays to do your assignment. Before looking through listing sites, you have to do your part and get to know the market in general. Learn as much as you can about the current trends and make yourself well-versed with the concepts that surround the market.

Finding a great deal is not a talent—it is just a combination of the knowledge you have of the market, the practical mindset, and the creativity and ability to see things in another perspective.

What to consider in buying an investment property?

By Randell Tiongson on March 28th, 2016

1 in 6 Filipinos owns real property other than the primary home. This is according to the 2012 Consumer Finance Survey of the Bangko Sentral ng Pilipinas (BSP). While others may use the second or third properties either as a halfway or vacation home or for the rich a ‘pamana’, others use additional real estate as an investment opportunity.

1 in 6 Filipinos owns real property other than the primary home. This is according to the 2012 Consumer Finance Survey of the Bangko Sentral ng Pilipinas (BSP). While others may use the second or third properties either as a halfway or vacation home or for the rich a ‘pamana’, others use additional real estate as an investment opportunity.

Especially in school and central business districts (CBD), there’s no shortage of rental properties. This is because continuous demand directly relates to the flow of income. If your property is near a university, every four or five years, there’s always a new batch of students looking for a place to stay. You can expect there’s always an individual eyeing a home near one’s workplace if your rental property is in a CBD.

Are you thinking of buying an investment property? Here are four questions to ask when buying an investment property. If you answer ‘yes’ to the following questions, you’re on the right track in becoming a real estate investor.

- Is the property location strategic?

Easy access to malls, parks, hospitals, and accessibility to public transportation increase the profitability of university towns and central business districts.

Quezon City, Makati City, and Paranaque City are the three most searched cities in the Philippines according to Lamudi’s 2015 white paper report. Why?

- Quezon City has many universities and colleges, research institutes, and commercial developments.

- Makati City is the financial center of the country with the highest concentration of local corporations and multinational companies.

- Paranaque is close to Makati City and Pasay City but offers more affordable housing options.

Ask yourself how close is the area from schools, offices, hospitals, malls, and main roadways and public transport if you are planning to buy a property investment.

- Will the area develop and grow in the coming years?

The search traffic for properties in CALABARZON, Central Luzon, and Central Visayas continues to increase in the same Lamudi white paper report. Search traffic in CALABARZON surged 130% from the 4th quarter of 2014 to the 1st of 2015. The reason for this is current and future developments in the region, namely in Cavite and Laguna.

The developments in these two areas show no signs of stopping. Nuvali, in Sta. Rosa, Laguna, has easy access to numerous commercial establishments, schools, leisure areas such as a wakeboarding park, and residential properties where the price per square meter is starting to match Metro Manila’s. Ayala Land, Inc.’s vision for Nuvali is to make it the next financial district south of Makati. This area will continue to grow and thus makes it a strategic location to invest in.

The area is a good investment opportunity if the area is situated in a less developed area that is primed to grow and progress in the future. Don’t join the race when it has already started; invest in properties in the early stages of development.

- Can you handle the monthly amortization?

Having enough to make the downpayment is one thing, paying your monthly amortization is another. Your payment terms, interest rate, and timeframe varies on your personal preferences. The only thing that stays permanent is the necessity to keep up with the monthly payments. Avoid late payments as this leads to paying more in interest. Do the math first and ensure you can afford the monthly amortization before you decide to invest in real estate.

You can use MoneyMax.ph’s comparison portal for housing loans to give you an idea at how much you can expect to pay on a monthly basis depending on your time frame and loan amount.

- Do you have savings for emergency situations?

As the landlord, you are liable to cover for unnecessary situations that may arise (unless otherwise stated in the contract). You should shoulder expenses for water leaks, roof repairs, and floor re-tiling among many other repairs. You’ll also be covering for utility bills and the homeowner’s association fees f your property is left vacant for several months.

The importance of having savings or an emergency fund is to cover for emergency situations in relation to your rental property.

You’re on the right track in buying a profitable property if you find yourself saying ‘yes’ to the questions above. Remember that when you invest in real estate, your intention is to earn and make money because you are investing. Make sure that the property you’re eyeing is profitable before you make a down payment.

———

Learn from the experts at iCon2016 this May 28, 2016. Hear the country’s leading experts: BSP Deputy Gov. Diwa Guinigundo, Rex Mendoza, Marvin Germo, Paulo Tibig, Dodong Cacanando and Reina Pama.

For details, visit HERE

House buying or renting habits of Pinoys

By Randell Tiongson on March 10th, 2015

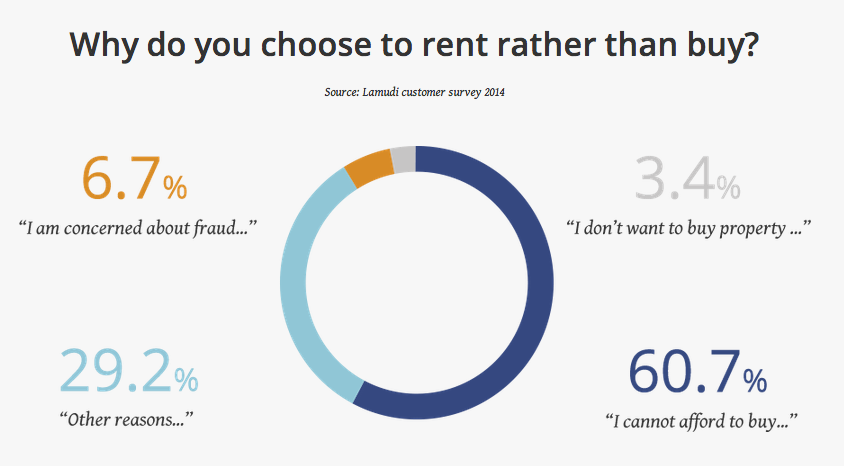

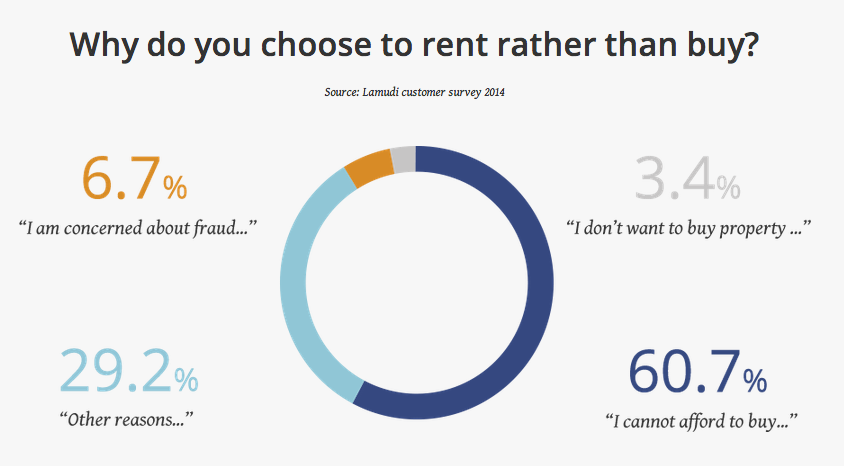

Affordability is top of mind for Filipinos who choose not to buy property, with more than 60 percent of renters in a recent survey of online house-hunters citing cost constraints as the primary reason they leased their home.

The findings are contained in new research from global property website Lamudi, which has recently released its first report on real estate in the emerging markets. The report, Real Estate in the Emerging Markets, provides a comprehensive overview of the property sector in 16 emerging countries, including the Philippines.

The report is based on a series of online surveys conducted with house-hunters and real estate agents in each country, as well as onsite data from Lamudi’s global network of websites. The research examines the habits of online property-seekers, while offering insights into the future of the property sector based on interviews and surveys with local property experts.

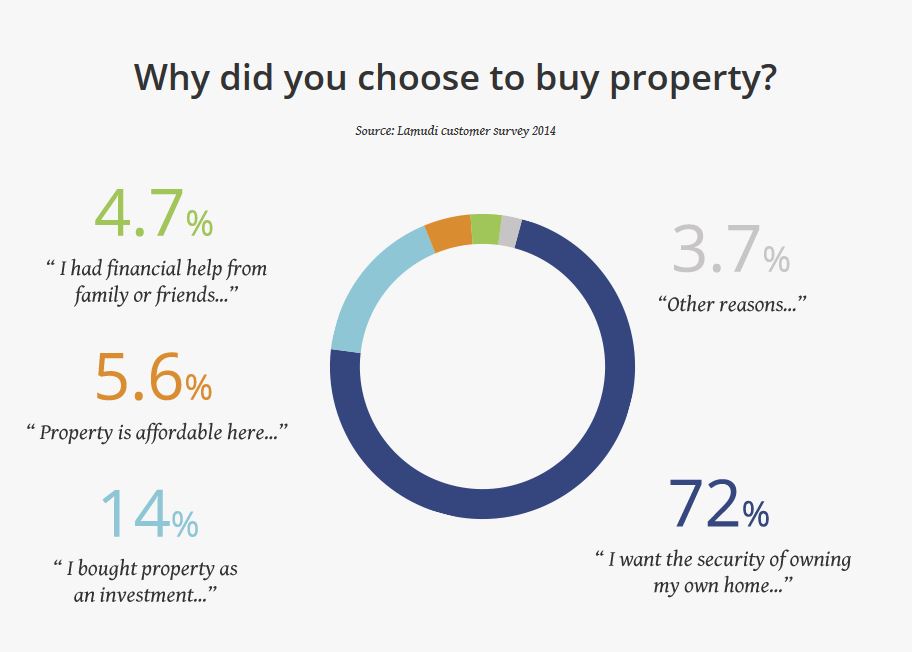

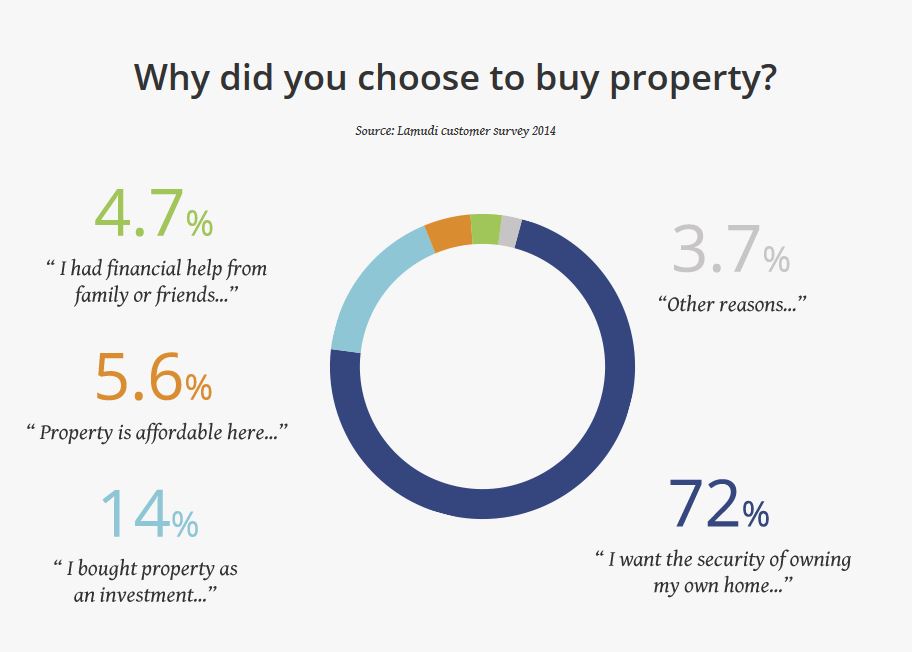

The customer survey examined house-hunting habits among buyers and renters. For renters, affordability emerged as the key reason why many Filipinos choose not to buy their own home. More than 60 percent of renters surveyed said they could not afford to buy property. For buyers, the main driver for owning property is security. Nearly three-quarters of buyers cited security as their primary motivation for purchasing a home.

According to the survey of real estate agents, the country’s economic outlook is seen as the top constraint on the property market, reflecting current concerns about a potential slowdown. However, agents and brokers remain overwhelmingly optimistic about the future of the market. More than 90 percent describe their outlook for the next 12 months as positive.

Lamudi’s Global Co-Founder and Managing Director, Kian Moini, said: “The primary conclusion that we have drawn from our research is that the future for the Philippine property sector is extremely bright. In fact, two-thirds of the real estate agents we surveyed are expecting growth of eight percent or higher in the property market this year. The country’s real estate market has emerged as one of the most promising in the Asia Pacific region.”

The report features a series of in-depth interviews with key figures from the property industry of each country, including Jose Romarx Salas, Head of Research and Consulting at Pinnacle Real Estate Consulting Services. Mr Salas said the key challenge for the Philippine property market was finding enough land to accommodate development. “In Metro Manila, that’s the challenge: looking for suitable land. Some developers are even willing to bid high, which pushes up already skyrocketing land prices in the capital,” he told Lamudi.

The 16 countries covered in the report are: Indonesia, the Philippines, Myanmar, Bangladesh, Pakistan, Sri Lanka, Jordan, Saudi Arabia, Nigeria, Kenya, Tanzania, Morocco, Ghana, Ivory Coast, Mexico and Colombia.

The full report is presented in an easy-to-read online format, available for viewing here.

ABOUT LAMUDI

Launched in 2013, Lamudi is a global property portal focusing exclusively on emerging markets. The fast-growing platform is currently available in 28 countries in Asia, the Middle East, Africa and Latin America, with more than 700,000 real estate listings across its global network. The leading real estate marketplace offers sellers, buyers, landlords and renters a secure and easy to-use platform to find or list properties online.