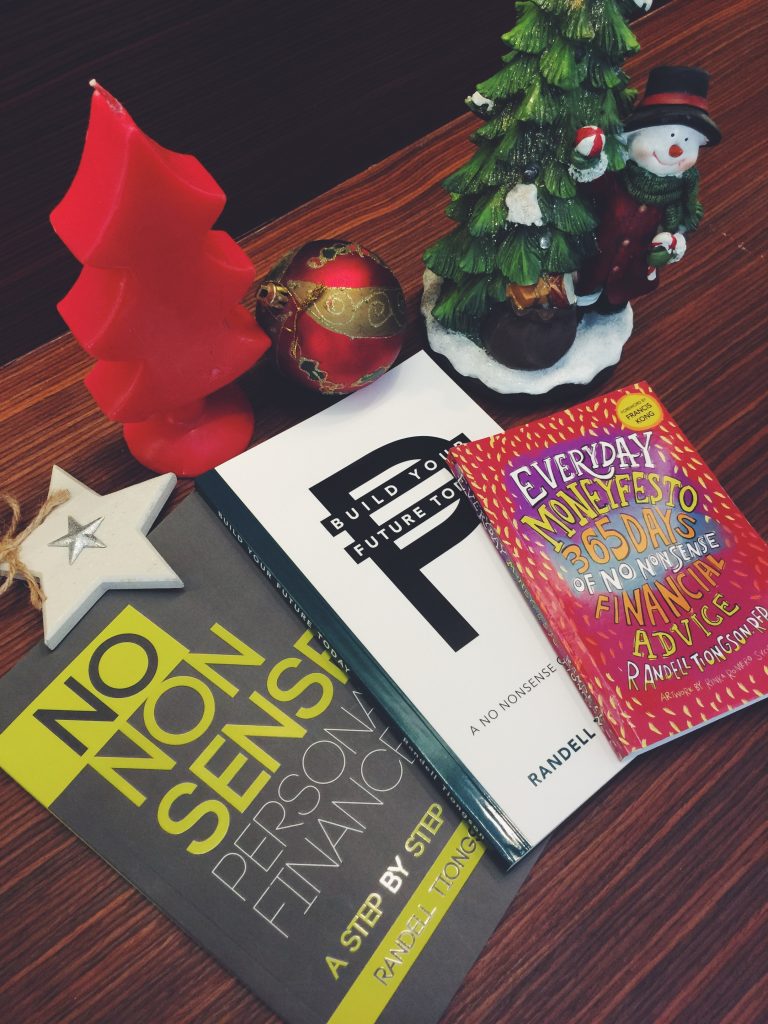

2017 Christmas Book Bundle Promo

By Randell Tiongson on November 21st, 2017

EXTENDED until Monday, December 11, 2017!

Due to numerous requests, I will be having a book bundle promo for some of my books once more. These books are great Christmas presents to the important people in your life. The gift of of financial education is perhaps one of the best gifts to give.

Bundle 1

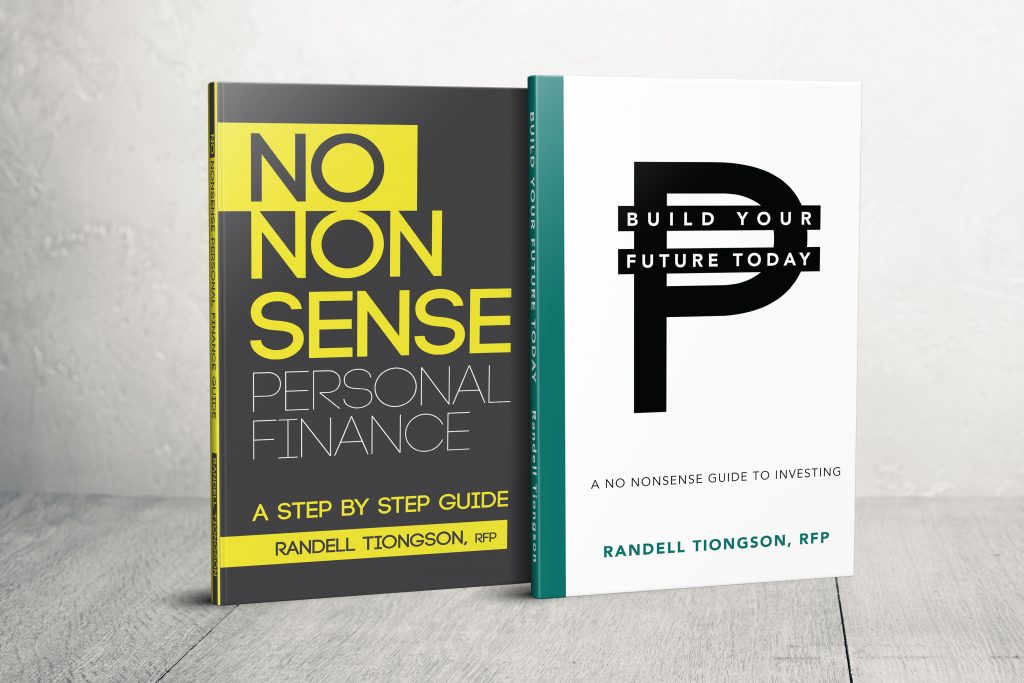

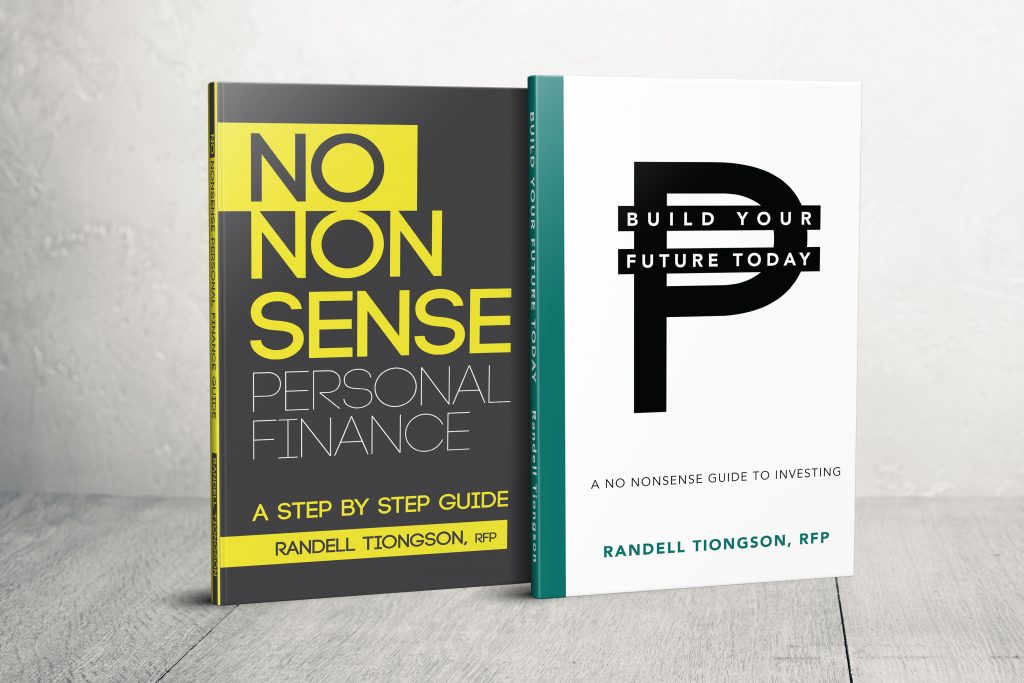

No Nonsense Personal Finance + Build Your Future Today + Everyday Moneyfesto at only P 1,200.00! Save P 300.00

Bundle 2

No Nonsense Personal Finance + Build Your Future Today at only P 800.00 Save P200.00

Bundle 3

5 Everyday Moneyfesto books (new compact edition) at P1,000.00 only! Save P500.00

Bundle 4

3 Build Your Future Today at P 1,000.00 only! Save P500

This promo will end on Wednesday, December 6, 2017. Shipping is free for Metro Manila orders, for provincial orders please add P100.00

Here’s how you can order:

- Deposit or transfer the payment to BDO 006440069496 or BPI 0249111309 under John Randell Tiongson.

- Send a picture of the deposit slip or transaction advice to [email protected] with your complete address and contact number.

- Expect the books in a few days!

Hurry, this is a very limited offer!

Some thoughts to ponder on…

Most of us are not financially prepared for their future. Studies show that as many as 90 percent of us are not on track to be able to comfortably retire. Too many people have bought into the lie that one day when we have more money we can start planning for the future. That kind of thinking is what ensures retirement never comes.

Setting aside P5,000 one time won’t change your financial future. However, setting aside a little bit of money consistently over a long period of time will build great rewards for the future. There’s no amount too small to start saving and no better time than now. You may not be a millionaire, successful businessman or stock broker, but that doesn’t mean you can’t start saving. Daily diligence with what you have can lead to long-term benefit.

Jesus has an incredible future planned for us, and when we save what we’ve been given, we free ourselves to act on what God wants to bring us in the future.

“For I know the plans I have for you, declares the Lord, plans for welfare and not for evil, to give you a future and a hope.” Jeremiah 29:11, ESV

Awesome book bundle promo!

By Randell Tiongson on February 25th, 2016

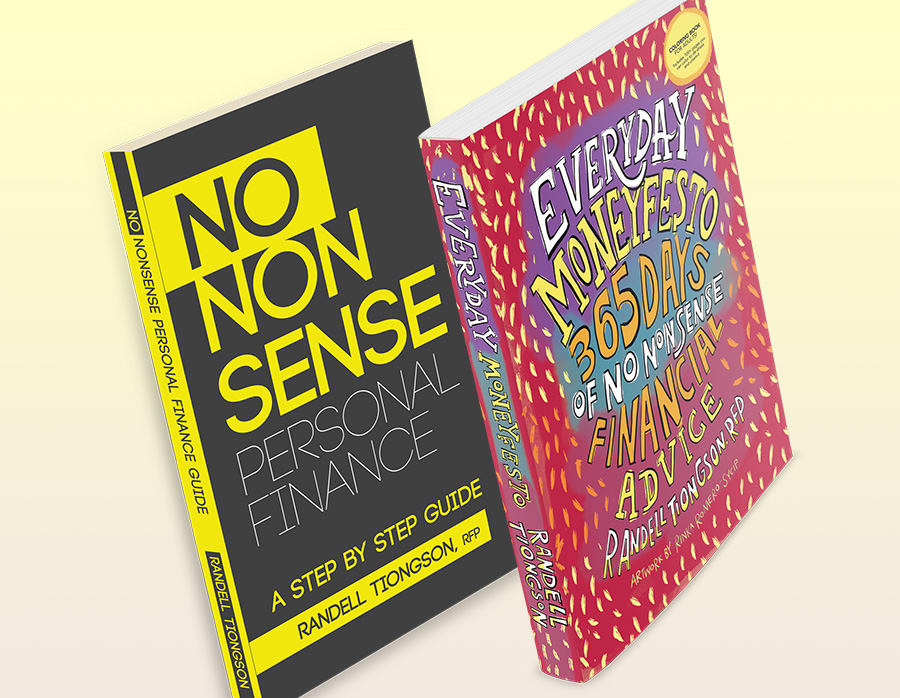

Here’s your chance to get 2 of my books at an awesome bundle promo!

No Nonsense Personal Finance: A Step by Step Guide — This book will take you to a step by step and instructional process on how to achieve financial peace the no nonsense way. On its 5th printing in just 2 years, this book has sold over 15,000 copies already. I have received so much feedback that No Nonsense Personal Finance has been a big help to so many and their testimonials are encouraging. This book outlines the 5 steps for you to help you achieve your financial goals.

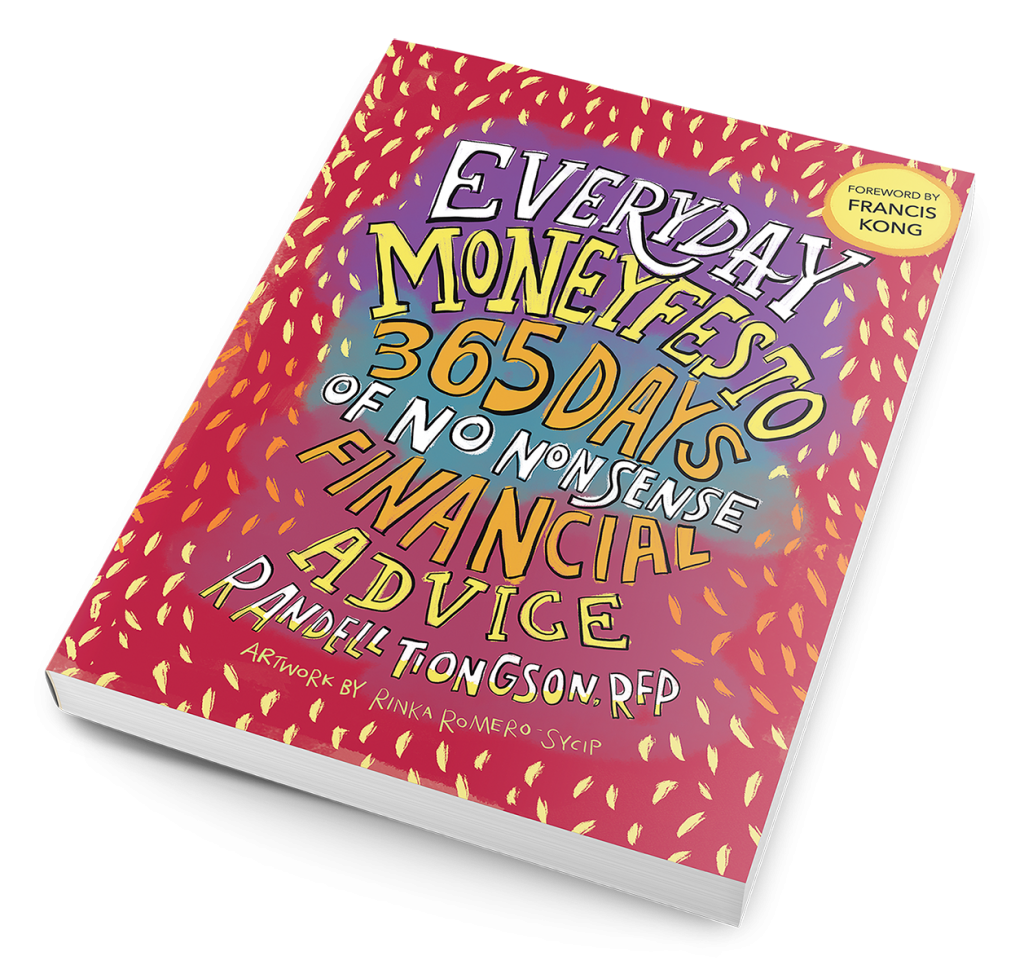

Everyday Moneyfesto: 365 Days of No Nonsense Financial Advise — My latest book released last December 2015. This book is a book of financial wisdom given in daily short but powerful quotes that can help you bring you closer to financial freedom day by day. In 2 months, this book has sold 2,000 copies already despite not being available in bookstores yet.

For a very limited time only, you can grab a chance to own both books with my latest promo. The regular price of both books is at P 1,100.00 but if you avail this bundle, the promo price is only P800.00 — a savings of P300.00 for both books!

But you need to do this fast as my promo ends on March 15, 2016.

To order, follow these easy steps:

- Deposit payment to BPI 0249-1113-09 under John Randell Tiongson

- Send a photo of the deposit slip to [email protected] along with your complete address and contact number.

- Free delivery for Metro Manila orders, for provincial orders add P100.00.

- Wait for your book/s in a couple of days.

Books that can help you

By Randell Tiongson on January 26th, 2012

Reading up on financial education

Question: What are the best books on personal finance that you can recommend? Thank you, sir.—Honney Natividad via Twitter

Answer: Best is a relative term and I may not be the right person to give you a qualified answer. However, I can give you my opinion on some books that I personally find insightful and helpful. Finance, even Personal Finance, is a very broad subject matter involving many disciplines and there are many good books out there that are very good read.

Answer: Best is a relative term and I may not be the right person to give you a qualified answer. However, I can give you my opinion on some books that I personally find insightful and helpful. Finance, even Personal Finance, is a very broad subject matter involving many disciplines and there are many good books out there that are very good read.

There are books that write about the technical aspects of personal finance and zeroes in on specific subject matter, i.e., investing, estate planning, stock market, insurance planning, accounting and the like. There are also books that tackle the broad spectrum of personal financial planning. There are also many books that tackle behavioral issues on finance that belongs on the motivational or self-help genre. Then there are the hybrids that try to give you a more balanced view on the technical as well as the behavioral issues on the finance and I personally go for these books.

Perhaps the most popular finance books are those written by Robert Kiyosaki, which were brought about by the highly popular Rich Dad Poor Dad bestseller. The book is so popular that it created some sort of cult-like behavior among many, which is quite disturbing if you ask me.

Rich Dad Poor Dad and Kiyosaki’s succeeding books have some good points but they are quite over-rated for me because they lack some specificity and many readers question the validity of his claims. Like any book, we should learn to eat it like a fish, we get the meat and throw away the bones, as the saying goes.

Let me give you a list of books that I highly recommend because I like the way they were written—balanced and grounded on solid financial principles; yet they can still help you get motivated. Sorry, Kiyosaki fans, you won’t find his books on my list.

1) Total Money Make Over and Financial Peace by Dave Ramsey—OK I admit it, I’m a Dave Ramsey fan boy and for a good reason. I like his straightforward approach on personal finance. His books, particularly Total Money Make Over is very practical and it is full of real stories of people who overcame financial difficulties.

Ramsey is a no-nonsense finance guru yet you can really sense his sincerity in trying to help people get out of the financial mess they are into. These two books are great starter books that will open your eyes and give you hope.

2) Pwede Na! The Complete Pinoy Guide to Personal Finance by Efren Ll. Cruz—Hands down, Efren’s books are the best personal finance book ever written by a Filipino. It is a concise yet surprisingly comprehensive book that will guide the reader in the many facets of financial planning and financial instruments. As the title connotes, it is indeed a complete guide, yet it will not overwhelm you as you find yourself glued to the pages.

3) Millionaire Next Door—by Thomas J. Stanley and William D. Danko. This is an iconic book that discusses the behavior of Millionaire in the USA. It is not only insightful, it will actually shatter many of our misconception on wealth and wealth accumulation. I particularly like this book because it is based on solid research. This is a good financial behavior book that may help you change your mindset.

4) Automatic Millionaire by David Bach—this book by a best-selling author gives you an overly simplistic view on achieving wealth and yet it is effective in its message that in eating an elephant, we need to do it one bite at a time. Simple, practical and sensible.

5) Money Matters by Larry Burkett—Financial counseling is the most effective route toward achieving financial security but many do not have access to good financial counselors or advisors. Money Matters is a form of counseling book and I like the question-and-answer format. The questions are very practical and real, not superfluous or ambivalent. The answers of Mr. Burkett are successful in providing advice in an emphatic way; yet, you will find that his answers have sound financial grounding.

6) Till Debt Do Us Part by Chinkee Tan—another book written by a local author that I highly recommend. Chinkee’s book deals with an issue that plagues many Filipinos and yet one that is hardly discussed openly. The author successfully convinces the reader that debt is not a good thing and yet it gives us hope that being truly debt-free is within the reach of the average Pinoy. I like the practical steps in finding a solution to the debt trap written specifically for the Pinoy psyche. Chinkee has written many best-selling books but Till Debt Do Us Part remains to be my favorite.

There are so many other good books and reading them is definitely a good idea. Just make sure that you are objective in reading the book and it does help to check the authenticity of the author. Many are led astray by what they read so I want to reiterate this concern. Notwithstanding the many “bad” finance books out there (local and foreign), I implore the Pinoys to get a book on personal finance and read. One good idea can change your future and redirect you to the path to financial peace.

I am in the process of writing a book myself but recommending it here will be self-serving so let me just stick to the six I mentioned. Financial wisdom will be yours if you seek it. Hope this helps.

Appears in Philippine Daily Inquirer