My finance events in the UAE 2017

By Randell Tiongson on July 15th, 2017

Financial education remains to be the leading reason why Filipinos are more empowered today more than ever. BSP studies shows that savings and investment rates are substantially improving, particularly those of the Overseas Filipinos.

Since 2013, I have been coming in and out of the Middle East to conduct personal finance training to the Filipinos and it is really encouraging how exposure to financial literacy programs really change the lives of many. Here’s what they say:

Randell Tiongson is the glue that hold the personal finance world together, so to speak. He is pure inspiration to those who hear him and he has opened my eyes on how crucial it is to be financially free. The Lord delights in who he is.

Anna Lusterio, Commercial Officer, Dubai Cable

Listening to Randell’s talks made me appreciate God’s words through the bible even more. I discovered how practicable the principles found in the bible are about money and Randell incorporates those principles to each of his talks very well, which made the topics for me weightier. As a Certified Public Accountant, I really find myself amazed at how knowledgeable Randell is about personal finance, insurance and investments. The great thing about Randell is that when he talks, it is not all theories. He has done it and lived it. He walks the talk, which encourages me to apply the lessons I’ve learned to my own personal finance.

John T. Sola, CPA Audit Manager KPMG Lower Gulf

Coach Randell’s Talk helped me a lot in re-aligning my long term financial goals and personal money management strategies. His true passion and dedication towards his advocacy of educating more and more Filipinos about financial education, inspired me to follow the same vocation in helping fellow OFW’s especially in the Middle East.

Pablo Santos Jr., Sales & Marketing Manager, Sony Middle East and Africa FZE

Coach Randell’s seminars are highly recommended to all Filipinos who want to set their goals and develop their strategies when it comes to personal finance. His topics are clear, timely and relevant to every Filipino investor. He purely educates and does not have any ‘ulterior motive’ for his attendees to purchase any particular product.

Charry Dela Cruz – Roldan, Assistant Vice President, Bank J Safra Sarasin

How did the No Nonsense talks of Coach Randell impacted our lives? Simple. It reminded us that you write down your (financial) plans but at the end of the day, it is the Lord that gives you wealth and therefore, you ought to share it to others.

Bernard and Rhea Anduyon, #TrulyRichCouple and Filipino finance advocates in Doha

I have always known that part of my salary should be kept as savings, thinking that it would be enough to sustain my daily expenses when I retire. Attending coach Randell’s seminars taught me the system to map out a plan not only for retirement but a complete personal financial plan with specific strategies and measurable goals.

Rommel Mercaida, Senior Telecom Engineer, Ooredo

Attending seminars for personal finance and meeting Randell Tiongson has been a big help to OFW’s like me. It helped me handle my finances better and I learned the basic and essential matters before investing. His seminars made me realize that there are certain things you have to consider first like improving your cash flows, eliminating debts, protection from certain risks and establishing emergency funds. I also learned that there are other form of investment vehicles that you can invest your money in like mutual funds, stocks, bonds, VUL’s and real estate. I hope that a lot more OFW’s will have the knowledge on financial literacy so they can be empowered and will not be a victim of scams.

Melvin Manalastas, Accounting Executive, DMCC

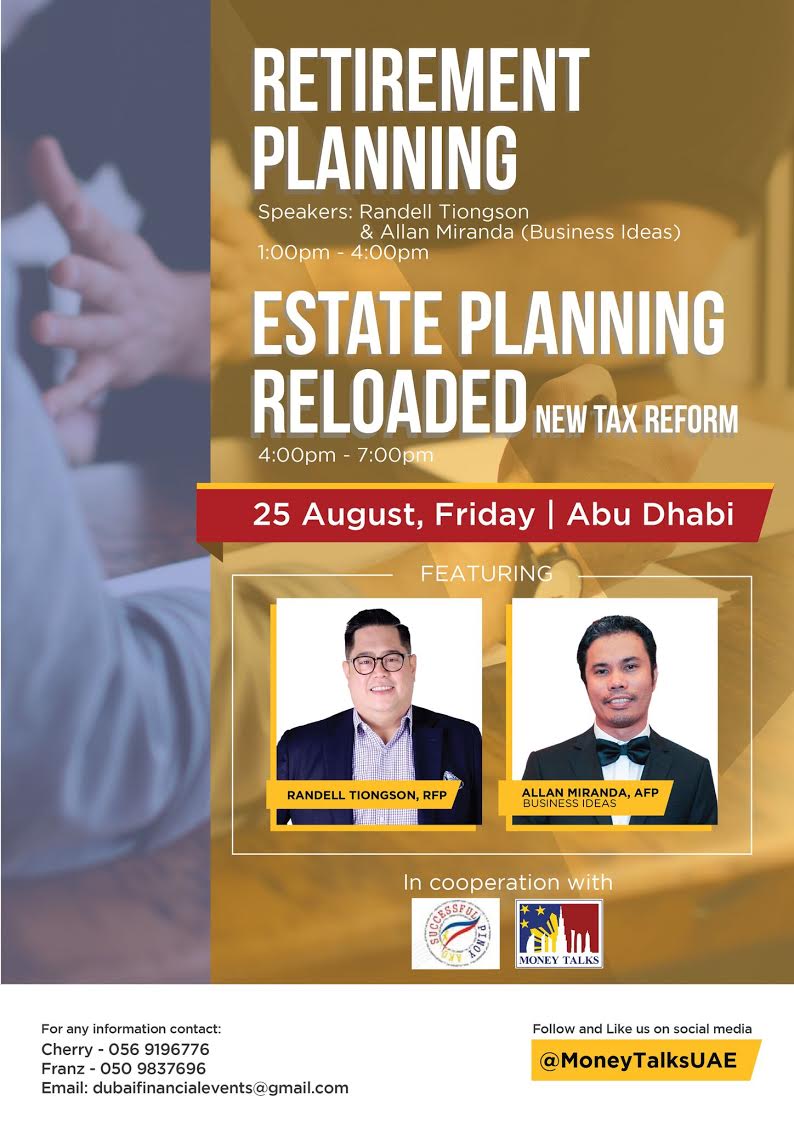

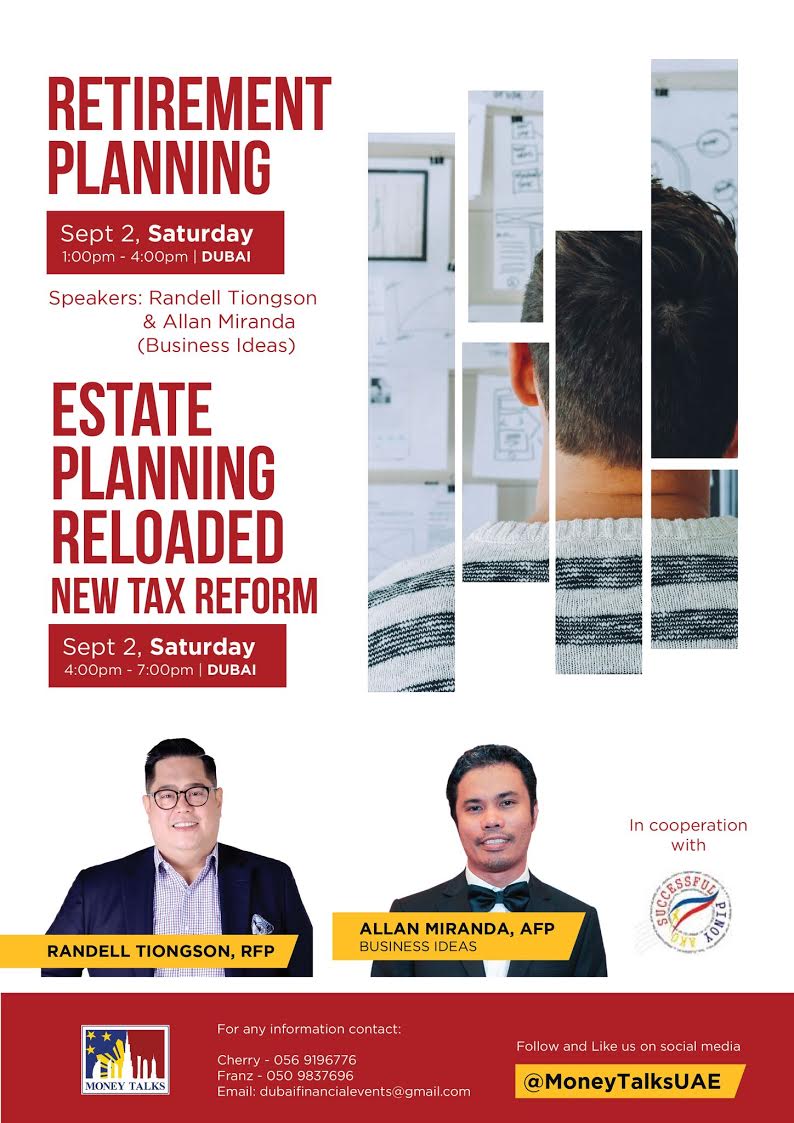

This August and September 2017, I will be running 2 key of my signature programs in the UAE once more:

Retirement Planning: Learn how to properly prepare for your retirement. At the end of the full day workshop, you will be able to prepare a comprehensive retirement plan that is suited for you and a plan that really works. Find out how you can truly live a life of comfort & learn about the proper investments that is best suited for your needs objectively from two of the most recognizable finance advocates of the country.

My good friend Allan Miranda will be joining me to discuss business options that can be used to help build retirement funds and how to options on business venture to enter during retirement. Allan Miranda is one of the most visible Filipino business advocates based in Dubai.

Estate Planning: As you build your wealth, it is important to also prepare for its proper distribution eventually. How will the Philippine estate laws affect your wealth? What are the cost implication of transfers? What are the tools you can consider? As a bonus, I will also give a brief on the new tax reforms that will have an impact on estate taxation.

Abu Dhabi Run – August 25, 2017

Details and Registration via https://goo.gl/xK8hDq

Dubai Run – September 2, 2017

Details and Registration via https://goo.gl/1HaZkb

Attend my seminars and help me make you an empowered Filipino!

5 Simple Ways for OFWs to Invest in the Philippines

By Randell Tiongson on May 13th, 2015

OFWs are generally the kind of people who leave home because they want to provide for their respective families, others still are looking to broaden their life experiences by working abroad for a time. With their time working abroad comes the idea of eventually putting the money they’ve worked hard for to good use.

OFWs are generally the kind of people who leave home because they want to provide for their respective families, others still are looking to broaden their life experiences by working abroad for a time. With their time working abroad comes the idea of eventually putting the money they’ve worked hard for to good use.

Most will find themselves putting that money towards small businesses that their families can run in their stead; others will start a savings account and allow the money they deposit to incur interest. There are other ways to grow one’s hard-earned money, such as investing.

Many people find the idea of investing somewhat daunting – the most common reaction is usually “don’t you have to study the stock market to get anything done?” There is a certain amount of study that comes with investing, but there are a number of accessible investment platforms available to the average OFW, and are usually tailored to one’s Risk Profile.

A Risk Profile basically determines how aggressive someone is when it comes to making an investment, or one’s Risk Appetite. The first thing anyone wanting to start an investment portfolio is to take a client suitability assessment questionnaire, which will allow you to see exactly what kind of investment vehicle best applies.

Of course, the kind of investment vehicle you choose depends on the amount of money you choose to risk, hence the need for one to take the assessment.

There are several ways to start your investment portfolio, and here’s five:

Mutual Funds

By far, investing in a Mutual Fund appears to be the simplest of the options when it comes to investment vehicles. This type of investment takes most of the work out of your hands and places it in the very capable ones of fund managers. Their job will be to grow the money you invested, without you having to monitor it constantly.

Here’s a list of mutual fund investments that you can access online:

Stock Investments

Arguably, investing in publicly traded stocks requires a certain kind of aggression in terms of your risk appetite, and some research. Buying stocks basically means becoming a shareholder in a publicly traded company. Being a shareholder means you own a part of the company, but only so far as much stock that you own in said company. The bigger your stock, the more you can participate, and the more you earn depending on the company’s performance.

stocks basically means becoming a shareholder in a publicly traded company. Being a shareholder means you own a part of the company, but only so far as much stock that you own in said company. The bigger your stock, the more you can participate, and the more you earn depending on the company’s performance.

Getting started requires opening an account with a broker, and here’s a list of online stock brokers accredited by the Philippine Stock Exchange:

Unit Investment Trust Fund (UITF)

This form of investment involves holding a certain amount of money in trust as part of the investment made. It shares a similar structure to mutual funds in the aspect that your money will be managed by fund managers. This is usually offered by banks, and differs from mutual funds because they revolve per unit investment, as opposed to the shares in a mutual fund.

Here’s a partial list of banks that offer UITFs:

- Metrobank

- BDO

- Union Bank

- BPI

- PNB

- Chinabank

- Security Bank

- EastWest Bank

Bonds

Given the propensity of OFWs to save their money in bank accounts, an investment vehicle that may also be available to them comes in the form of Bonds. This form of investment is generally offered by large corporations and government offices (Retail Treasury Bonds) as a means of raising funds or essentially borrowing from the public. They have a fixed maturity date.

Here’s a few banks that also act as gateways to purchasing Bonds

- PNB

- BDO Unibank

- BPI

- Metrobank

Real Estate

This type of investment isn’t necessarily unusual, but leans more towards preparing for a future home, or somewhere to put up a business. This form of investment requires a higher amount of money to start with as opposed to say, mutual funds. The money invested into real estate generally means having enough to make the payments to the land that you have purchased, and the lower the interest rate, the better.

What may eventually earn money from investing in real estate is the way land use changes over the years. One can acquire property through the Register of Deeds, but make sure to check the land title for encumbrances (mortgage, debts, and the like).

These are just some of the ways that OFWs can invest in the Philippines. It mostly takes a certain amount of patience and research before you pick your investment gateway.

“Ang tamang pag-gastos” – my first ‘tag-lish’ piece!

By Randell Tiongson on December 17th, 2012

Early this year, I was given an opportunity to share on personal finance to OFWs in Hong Kong through Smart & PLDT’s free publication called Smart Pinoy. I wish to share my first (and hopefully not last) attempt in writing a ‘tag-lish’ article. This is probably an article that I had to write with most difficulty and yet the outcome was not yet up to standards. Oh well, I can always try again….

*Thank you John Palanca and Greg Matubis (PLDT International) for being a risk-taker and publishing my pieces.

———————–

Ang tamang pag-gastos

Marami sa atin nahihirapan mag ipon. Studies show that Filipinos are one of the lowest savers in Asia at ito ay isa sa pangunahing dahilan kung bakit marami sa atin ang nahihirapan sa buhay.

Alam natin na ang tanging sagot para makaalis sa kahirapan ay ang tamang pag-iipon. The most sensible advise we often give is this: “it’s not how much you make, it’s how much you save.” Ang tamang pag-iipon ay ang pinakamagandang solusyon sa ating mga suliranin sa pera. Ang pag-iipon din ang pinaka malaking dahilan kung bakit natin iniwan ang ating mga minamahal at makipag-sapalaran maging isang OFW. With proper savings, you can invest for the future and improve your financial condition which will eventually allow you to appreciate the fruits of your hard work.

Alam natin na ang tanging sagot para makaalis sa kahirapan ay ang tamang pag-iipon. The most sensible advise we often give is this: “it’s not how much you make, it’s how much you save.” Ang tamang pag-iipon ay ang pinakamagandang solusyon sa ating mga suliranin sa pera. Ang pag-iipon din ang pinaka malaking dahilan kung bakit natin iniwan ang ating mga minamahal at makipag-sapalaran maging isang OFW. With proper savings, you can invest for the future and improve your financial condition which will eventually allow you to appreciate the fruits of your hard work.

Ngunit marami sa atin ang nahihirapan makapag-ipon kahit na lumaki na ang ating kita sa pag hahanap-buhay bilang isang OFW. Ang susi para tayo ay makapag-ipon ng maayos ay ang tamang pag-gastos. Kahit lumalaki ang ating kita pero lumalaki din ang ating gastusin, hindi rin tayo nakapag-iipon ng maayos. For us to properly save, we need to spend properly as well.

Dalawang uri ang ating pag-gastos, ito ay tinatawag na ‘needs’ at ‘wants’. Ang mga needs ay mga gastos para tayo ay mabuhay, samantalang ang mga wants naman ay mga gastos para tayo maging masaya. It is a good idea to start determining our expenses whether it is a need or it is a want. Ang mga gastos upang mabuhay (needs) ang ating pangunahing priority bago ang mga wants. Mga halimbawa ng needs ay rent, food, education, medicines – mga gastos na kinakailangan natin para mamuhay ng matiwasay. Samantala, ang mga gastusin na wants ay mga regalo, pasalubong, gadgets, shopping, sine, cell phone, load, restaurants, laruan, etc. It is important that we are aware of our expenses and categorize them according to needs vs. wants. As a general rule, needs should always be prioritized over wants.

Wala namang masama sa mga gastusin para maging masaya – lahat tayo ay nangagailangan matikman ang mga bagay na nagdudulot sa atin ng kasiyahan. Ang kailangan lang natin ay tamang prioridad. Maganda kung mailista natin ang mga gastusin at paghiwalayin ang needs vs. wants. Makikita natin sa listahan kung saan napupunta ang mga gastos natin, maayos ang pag distribute ng sahod at maitatalaga natin ang amount na pwede natin itabi kada-buwanan. If kailangan natin mag adjust para makapag-ipon ng tama, pwede tayo magbawas sa mga gastusin na wants.

Ang tamang pag-iipon, pag gastos at sakripisyo ay ang tunay na susi para sa isang matiwasay na buhay.