Best performing Equity UITFs (YTD)

By Randell Tiongson on August 28th, 2013

The equity market has been declining and virtually wiping out gains for the year. The argument by many is index funds perform better than manage funds but it seems that argument does not hold true for the Philippine situation.

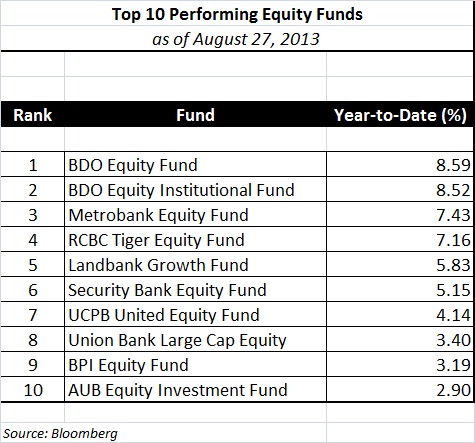

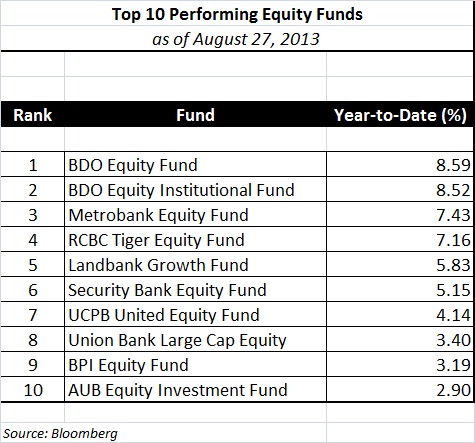

Despite the massive decline of the market, 6 out of the top 10 equity UITFs was still able to post beyond 5% growth in their year-to-date performances, as of August 27, 2013.

The following are the year-t0-date results of the the top 10 Equity UITFs:

The best performing UITFs in 2012

By Randell Tiongson on January 25th, 2013

Are you considering investing in UITFs?

UITFs or Unit Investment Trust Funds are pooled funds offered by the trust department of the major banks of the country.

But what is a UITF? As per the Trust Officers Association of the Philippines (TOAP), they defined it as “an open-ended pooled trust fund denominated in pesos or any acceptable currency, which is operated and administered by a trust entity and made available by participation. Each UITF product is governed by a Declaration of Trust (or Plan Rules) which contains the investment objectives of the UITF as well as the mechanics for investing, operating and administering the fund. Most UITFs are considered medium to long term investments. Clients considering to invest in UITFs must have the financial resources to stay invested in them for a reasonable period of time in order to maximize earnings potentials. If the funds to be invested will be needed by the client in the immediate future, the UITFs may not be a suitable investment vehicle for such client.”

UITFs are very good investment instruments for investors with a longer time horizon and are comfortable with the volatility typical of pooled funds. Pooled funds can be high risk when invested in equities, low risk when invested in fixed income (bonds) or moderate when invested in a balanced fund.

Before jumping into UITFs, it is best that you understand the nature of this instrument. Further, it is advisable that you check on the fees associated with pooled funds — they are not all the same. Some funds require entry and exit loads and some funds have higher management fees. Fees will ultimately affect your yields.

2012 was a good year for investments, particularly for equities so it is expected that equity UITFs will do really well. I need to caution readers, however, that returns are not the sole factor if selecting a fund. Aside from fees, it will be good to check on how volatile the funds are, experience of the fund manager and size of fund. Bigger funds are usually less volatile but may not have the best performance. Further, equity funds that are more diversified and having more variety in the fund is generally less risky. Let’s compare two funds even if they are both equity funds — a fund that is invested in only 10 companies might perform better than a fund that is invested with 20 to 30 companies since certain calls are easier to make. However, the fund with fewer companies are riskier since one bad call of the fund manager can have a large impact on the fund.

My advise — talk to your bank and do your homework. Regardless, I am a fan of UITFs because in the long run, these investments will help me achieve my financial goals. Personally, I go with bigger sized funds that offers the lowest fees offered by the larger and more stable banks.

To know more about UITFs, please read my earlier blog HERE. You can also check out performance of Philippine funds at Bloomberg’s SITE.