Basic economic facts you should know

By Randell Tiongson on October 10th, 2018

Economics is often a subject matter people talk about with passion and yet there are also many who will shy away once the word “economics’’ shows up.

Investopedia.com defines economics as “… a social science concerned with the production, distribution and consumption of goods and services. It studies how individuals, businesses, governments and nations make choices on allocating resources to satisfy their wants and needs, and tries to determine how these groups should organize and coordinate efforts to achieve maximum output.”

I know definitions sometimes do not help so let me try to help you be a little more ‘economics’ smarter by discussing basic facts you should know.

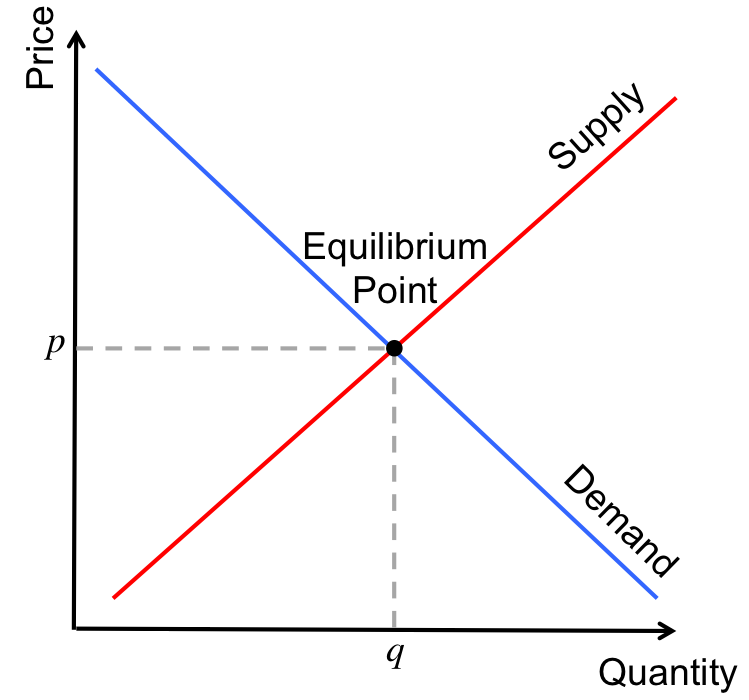

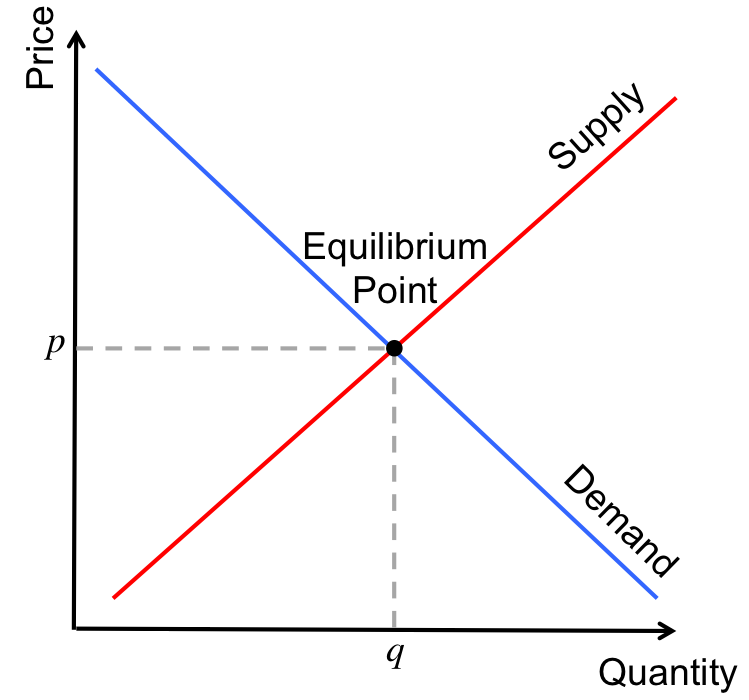

1. The foundation of economics is the “Law of Supply and Demand.”

Whenever supply of something increases its price decreases and whenever demand increases price increases and the reverse. The main reason why certain commodities are becoming expensive is because of the lack of supply and demand is constant or even increasing. For example, the price of rice becomes expensive because of lack of supply brought about by poor food production or lack of imports. When the supply of rice increases, you can expect the price to begin to go down. Sometimes, supply remains constant but demand goes down which will result to oversupply and you can expect prices to also go down. Once you get this fundamental law, you pretty much understand a whole lot more about economics.

2. Economics has two main streams: Microeconomics and Macroeconomics.

Microeconomics studies individuals and firms’ behavior, incentives, pricing, margins, etc. which helps in deciding allocation of scarce resources. Macroeconomics studies how the aggregate economy behaves. It deals with larger things such as interest rates, Gross Domestic Product (GDP), inflation and other stuff you would hear or read about in business news. Microeconomics is more useful for managers and macroeconomics is more used by investors.

3. Inflation.

We already know the prices gets goes up over the years. A bottle of your favorite soft drink was much cheaper when your father was young and it will be more expensive by the time it will be your child’s time. Inflation (measured in percent) is a measure of how much a bunch of products have increased in price from last year, or more commonly known as inflation rate. Mature economies like the U.S., Japan, U.K. and the like will usually have inflation rates of about 2% per year. Emerging economies like the Philippines will have higher inflation rates. One of the key roles of the Bangko Sentral ng Pilipinas (BSP) is to manage this rate and to keep it low. Obviously, this is easier said than done and there are many factors that can affect inflation, internal and external.

4. Gross Domestic Product or GDP.

This is the basic measure of the size of an economy. This is conceptually equal to the sum of incomes of all people in the country or sum of the market value of all goods & services produced within a country’s borders for a specific time period. GDP is computed on an annual and a quarterly basis. To simplify, GDP is a broad measurement of a country’s overall economic activity – the leader of the indicators.

5. Interest Rates.

When you lend money to someone, you expect to get some form of extra payment and that is essentially what interest is. Generally, the short term interest rates are being set by the BSP which they use to help manage economic activities such as inflation and money supply. If the BSP wants more money in the system, it lowers interest rates and if they want to map out excess cash in the system (which can contribute to inflation), they increase the rate. The BSP of late has been increasing the interest rates as a way to curb the very high inflation rates we are experiencing now. As to how effective this is in actually affecting economic activity is a discussion for another time.

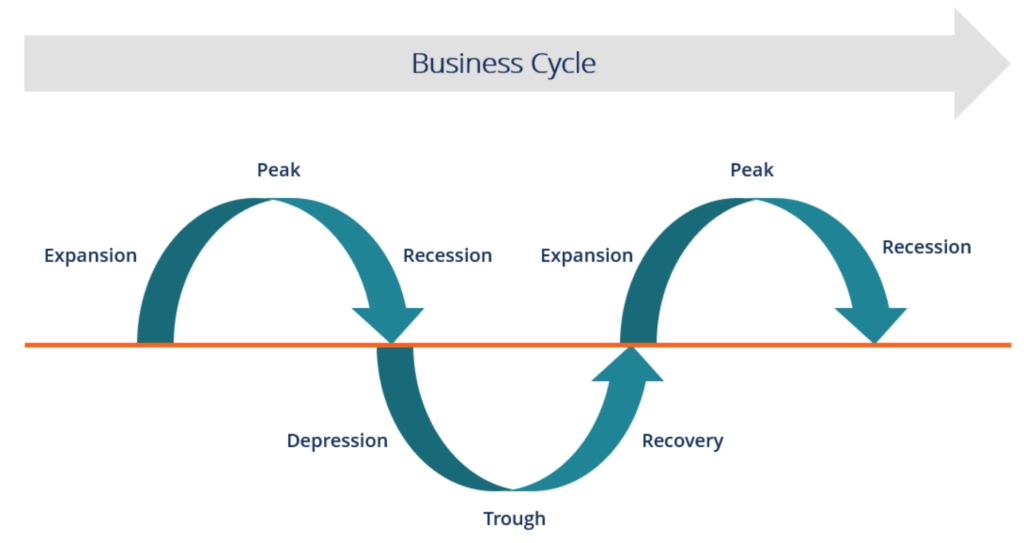

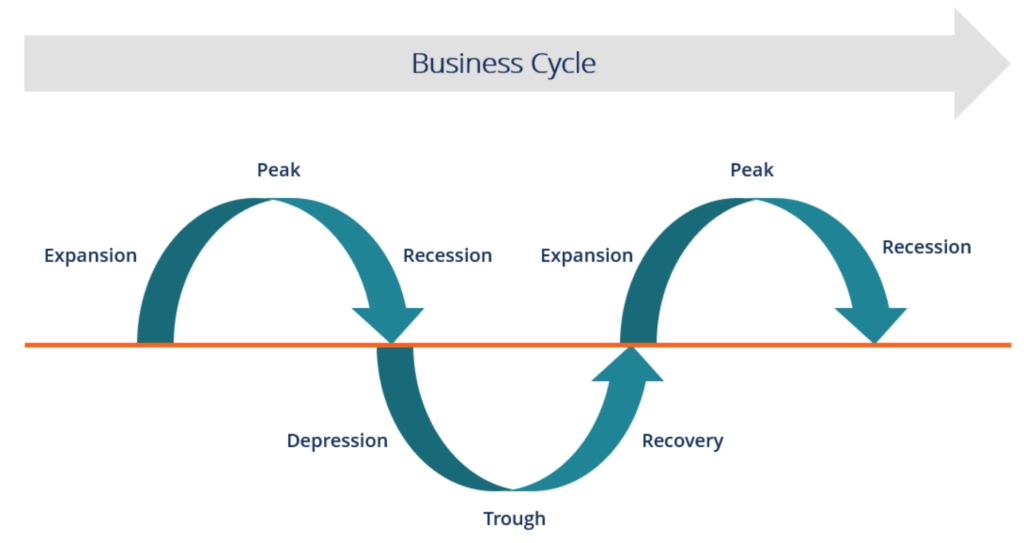

6. Business or Economic Cycle.

Economies have their periods of growth and decline in cycles of a few years with some economies experiencing longer cycles over some. The start of the cycle is recovery, followed by expansion, then by decline (or contraction) and finally by recession which is a period of negative growth and/or increasing unemployment. And the cycle goes on again, and again, and again.

7. Fiscal Policy.

To a great degree, the government can affect the growth of the economy by the way they spend. When the government spends more, it can lead to more demand which can increase price, thus high growth and higher inflation and vice-versa. Theoretically, governments try to spend more during periods of low growth & low inflation and cut spending during periods of high growth & high inflation. But then again, that’s only in theory it seems.

8. Monetary Policy.

Basically, it consists of the actions of the BSP, the Monetary Board and other regulators. Their actions lead to the growth or contraction of the money supply by setting interest rates, buying and selling of government securities and setting bank reserves. After all, money is the life blood of the economy so when you fiddle with money supply, you influence the economy as a whole. Again, that is in theory.

There you go, 8 fundamental facts you need to know about economics. It really isn’t as difficult as we thought it would be, right? Knowing more about these things will make you wiser in handling your finances and investments.

Now try to discussing these ideas with your friends next time you have coffee with them and they will think of you as more ‘economics’ smarter than they are, ha, ha!

2016 Outlook, part 4

By Randell Tiongson on January 27th, 2016

For this installment of the 2016 Outlook, it is both an honor and a privilege to present the views of one of the most respected fund managers of the country.

————

The 2016 Outlook of Marvin Fausto

2015 was quite a challenging year for the investing public given the volatilities of the markets both for the bonds and equities. In fact, the best asset class that performed last year was deposit or money market funds since the market values of bond funds and equity funds were down as of year-end compared to the start of the year. Returns of these investments were negative on average. Many economists and analysts point to figures that trended below expectations. GDP growth for one is turning out to end 2015 near the 6% level, a full notch below Government’s forecasts of above 7%. Interest rates increased much faster that affected bond returns while earnings of stock exchange listed companies went through a series of downgrades throughout the year giving disappointing growth rates that caused much stock market selling towards the latter part of the year.

I mentioned in my report to Randell’s column last year that investments will be data dependent and that should numbers disappoint, such as the country’s GDP growth, investors will move accordingly.

“…the premium that investors give to the Philippines may be given a second look and will be adjusted accordingly”.

For the stock market, my view on investment strategy was more of a trading opportunity.

“With valuations remaining above historical levels and as trading volumes decline, stock market traders should remain selective and increase positions during market downturns and reduce holdings during market rallies”.

2016 will be a continuation, in my view. As the great unwind unfolds – that is, when the largest economy as the USA reverse the 7-year-long liquidity push stemming from near zero interest rates to spur economic activity – markets will react accordingly. The asset price excesses brought about by investors’ search for higher yields outside of the US is now reversing back home as the US dollar strengthens and the rest of the world, including China, currencies weaken. As we go through this period of reversal, higher than historical volatility is to be expected. Human behavior, particularly of those that have only experienced a bull market (or investors only since 2009), may undergo a long drawn phase of anger and denial until the point of indifference. For the Philippines, the added uncertainties brought about by election results and the potential weakening of OFW remittances will not help stabilize confidence. Even as the economy is expected to remain resilient at above the 6% GDP growth rate, confidence on the bond market as well as the stock market will remain cautious.

At this point, investors are well advised to take a step back and not lose sight of why they are investing in the first place. Investing should first and foremost be for a purpose, for a reason, and for a need. Markets go up and down. That is how it works. Match goals with risk appetite and horizon, implement your strategy, and let the markets run its course.

————-

Marvin V. Fausto is President of the IFE Financial Advisers, Inc.. He was the former Senior Vice President and Chief Investment Officer of the country’s largest bank, BDO Universal Bank and in charge of the Investments unit managing over P700 Billion under the BDO Trust Banking Group. He recently took his early retirement having worked for over 30 years in the fund management industry and is now embarking on a new venture as a consultant to COL Financial to launch the first fund supermarket in the country making funds available online and easily accessible to everyone.

Marvin V. Fausto is President of the IFE Financial Advisers, Inc.. He was the former Senior Vice President and Chief Investment Officer of the country’s largest bank, BDO Universal Bank and in charge of the Investments unit managing over P700 Billion under the BDO Trust Banking Group. He recently took his early retirement having worked for over 30 years in the fund management industry and is now embarking on a new venture as a consultant to COL Financial to launch the first fund supermarket in the country making funds available online and easily accessible to everyone.

He held the position as head of the Trust Banking Group of Equitable PCI Bank from 2002 to 2007 primarily responsible for its overall business and operations. He also held the position of Vice President and Investments Head at Citytrust Banking Corporation. He started his career as an analyst at the former Far East Bank & Trust Co.

After having served as President and director, Mr. Fausto is currently a Board Adviser to the Trust Officers Association of the Philippines, the umbrella organization of the Trust Industry. He was also the Founding President and current Board adviser of the Fund Managers Association of the Philippines. He is also a member of the Board of Advisers of the CFA Society of the Phils.

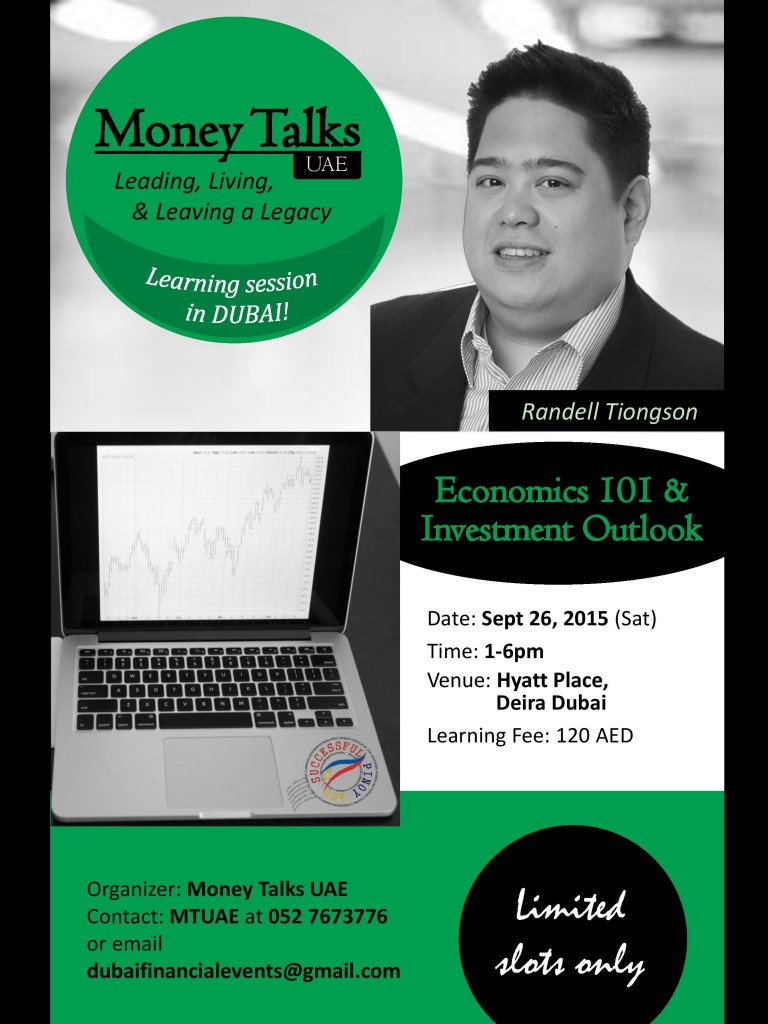

Special finance events for Dubai & Abu Dhabi OFWs!

By Randell Tiongson on August 18th, 2015

I will be back in the UAE for a series of training for the OFWs this September! It’s time to level up learning and be on your way to financial peace!

1) Economics 101 & Investment Outlook (Dubai) — this program will discuss the rudiments of economics especially matters that will have an effect to investors. How does interest affect investments? How does inflation play a factor in growing your wealth? How does monetary policies used to spur the economy?The program will touch up on basic macroeconomic learning as well as a thorough look on the Philippine economy as a bonus feature of the event. It is high time that we all understand economics and how it affects our everyday lives!

To register, click HERE or email [email protected]

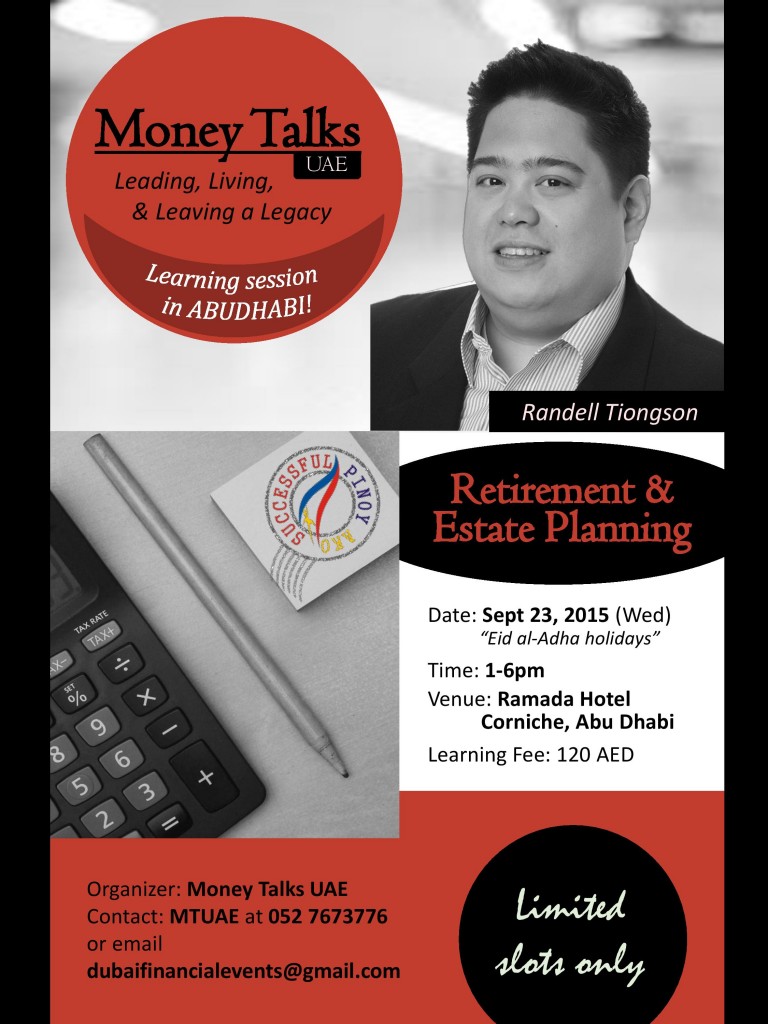

2) Retirement & Estate Planning (Abu Dhabi)

Studies shows that only 1 to 2 out of 10 Filipinos prepare for retirement. Studies also reveals that the few who prepare for retirement, most of them will only exhaust their retirement funds halfway through retirement. Filipinos are experiencing longer life expectancy but unfortunately, huge costs are needed to live a life of comfort during those years.

Consider this: If you can generate 75% of your pre-retirement income during your retirement years, you will live a life of comfort; if you can only generate 30-50%, you will live a life of struggle. For a 20 year retirement, you need at least 20 years of preparation — if you plan to retire at 60, then you should start preparing at 40.

As and added feature, I will also discuss basics of estate planning under the Philippine setting. Many Filipinos are unaware of why estate planning is important to them.

To register, click HERE or email [email protected]

HURRY! We are only limiting this offerings through limited slots only.