Top 5 mutual funds in the last 5 years

By Randell Tiongson on August 10th, 2015There has been a lot of anxiety with what’s happening in the equities market. External forces have affected the local bourse and many investors are jittery. China, Greece and a slowing down of the economy has largely contributed to some declines lately.

The equities market are behaving the way it is supposed to behave, it goes up and down and it is largely sentiment driven. How about mutual funds? Are the fund managers doing their jobs in ensuring growth in their funds despite the volatility?

I recently checked out how the mutual funds are doing and I am happy to note that while the short term gains are very minimal, even losses for some funds, many funds are doing admirably when you look at them from a long term perspective… say 5 years. I have always subscribed to the belief that investing in the stock market is more about time and less about timing — time in the market is better than timing the market. Of course many traders will disagree but my purpose of going into the equities market has always been from an investors perspective and not of a trader.

When investing in pooled funds like mutual funds or UITF, it is best that you do so with a long term perspective — the longer you stay, the better it is! I recommend that you stay invested in your funds for as long as you can, and you only redeem them when you have already hit your objective. It is always best to know what your investment objectives are, as well as your time frame and risk tolerance. Once you have established them and invested your money, don’t react too much with how the market moves and always view your investments from a long term perspective. It will make you less jittery and it will keep you sane, trust me!

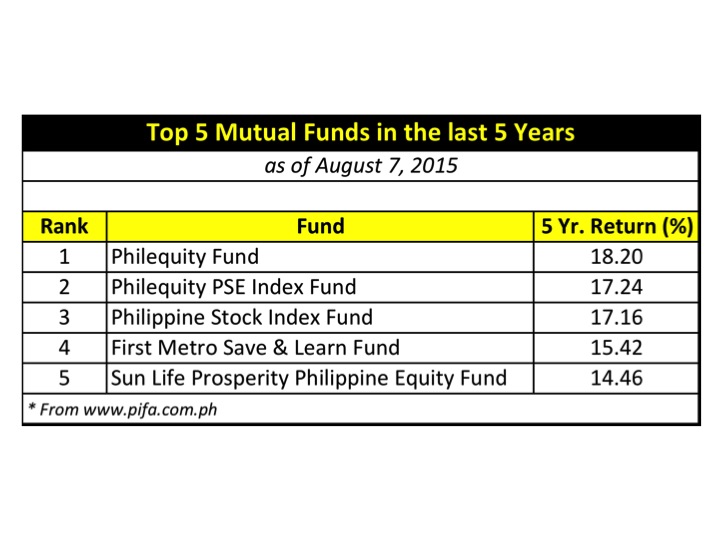

Below is a summary of the top 5 mutual funds in the last 5 years. Always remember, however, that past performance is not an indication of future performance — today’s top performer can be tomorrow’s laggard. A strategy I use is peso cost averaging — I invest in a monthly basis regardless of where the market is. But, whenever the market dips and I have investible funds, I try to buy more. It may not be the best strategy but it is a strategy that works for me. Of course, always remember to diversify your investments.

Happy investing!