Should you do cost averaging?

By Randell Tiongson on May 18th, 2016Question: I am Sam, in my 30s and an employee. After many years, I was finally able to open two investment accounts, one for UITFs and another one for stocks. After joining many Facebook groups on investing and reading your blog, I learned about the strategy called peso cost averaging. Is peso cost averaging always the best strategy? As I am a long-term investor, wouldn’t it just be better to make a lump sum investment instead? Thank you for your help.—Sam via e-mail

Answer: Hi Sam! Congratulations on opening an investment account, and two for that matter! It is good to know that you’re taking the initiative to read and learn about investing. It’s always better to do research and study first, instead of facing something head on, especially in investing. Learning and researching beforehand tells me that you have the discipline to make smart decisions, instead of depending solely on your instinct and gut feeling. Making smart decisions is important when it comes to investing.

As for your question, peso cost averaging is a great strategy because this builds the habit of setting aside money for your investments regularly, unlike lump sum payments. However, it is not without drawbacks.

Pros and cons of peso cost averaging or PCA

Pros

It is affordable. Gone are the days when you need hundreds of thousands of pesos to start investing. Today, you can open an investment account for P5,000 and put as little as P1,000 depending on the frequency you prefer (pro tip: put a set amount into your investment on a monthly basis). PCA comes into play when you buy investments, be it more units of your UITFs or stock shares, on a regular basis. For those who cannot afford a lump sum investment and have only a few thousands to spare, PCA is a good first step into investing.

You ride market highs and lows. Markets tend to follow an up-and-down cycle. One day, company A’s stock may be priced at P2 per share, and then the following day, it can dip to P1.50. PCA evens out your risk by buying shares in different prices. Sometimes you can buy shares that are a little bit more expensive than the last time you bought them, but you can also buy shares for a lower price at other times. In a lump sum investment, if you buy shares during a market high and it tanks, it will be harder to recuperate your losses, unlike in PCA, where you buy shares during both market highs and lows.

You lessen your emotional investment. When you put a lump sum investment and it tanks the following day, week or month, it would be harder on your psyche than if you put in P1,000 every month through PCA and lost. When you do PCA, you become mechanical, rather than emotional, when it comes to your investments. You’re putting in P1,000 every month because you’ve built the habit. If the market tanks, it’s the best time for you to buy, unlike in lump sum investing—when you buy high, you pray for the market to go up so you don’t lose your hard earned money.

Cons

You can miss out on bigger returns. PCA allows you to ride the highs and lows of the market, so this evens out your risk. But you’ve heard the saying, ‘high risk, high reward,’ and when you buy shares during a market low with a lump sum investment, you may be jumping for joy when you get your returns. A 20-percent return on a one-time P500,000 investment is P100,000. In PCA, you’ll be buying stock shares or index fund units at different prices, so your returns may not add up to P100,000 even if you’ve put in P500,000 over time. It’s best to note that no one can really time the market and there’s no saying when the market will bottom out, so it is best to do your research first before deciding on whether to do lump sum investing or PCA.

It is more costly. As you know, every time you make a trade, whether it’s a buy or a sell, you pay a certain amount of fees, such as transaction or servicing fees, trust fees and management fees, among others. Fees vary depending on your investment (e.g. mutual funds, UITFs, stocks), so it’s best to check the website of your provider or broker for the specifics. In PCA, if you invest P1,000 every month, you will pay fees once a month or every time you make buy and sell. In a lump sum investing, you only pay twice—once you buy and once you sell.

Now, that you know the pros and cons of peso cost averaging, you can decide whether or not to push through with PCA. However, as I mentioned earlier, PCA helps you build the habit of saving (instead of spending) your money. You can do both: put in a lump sum to open your initial investment account and then add a percentage of your income regularly.

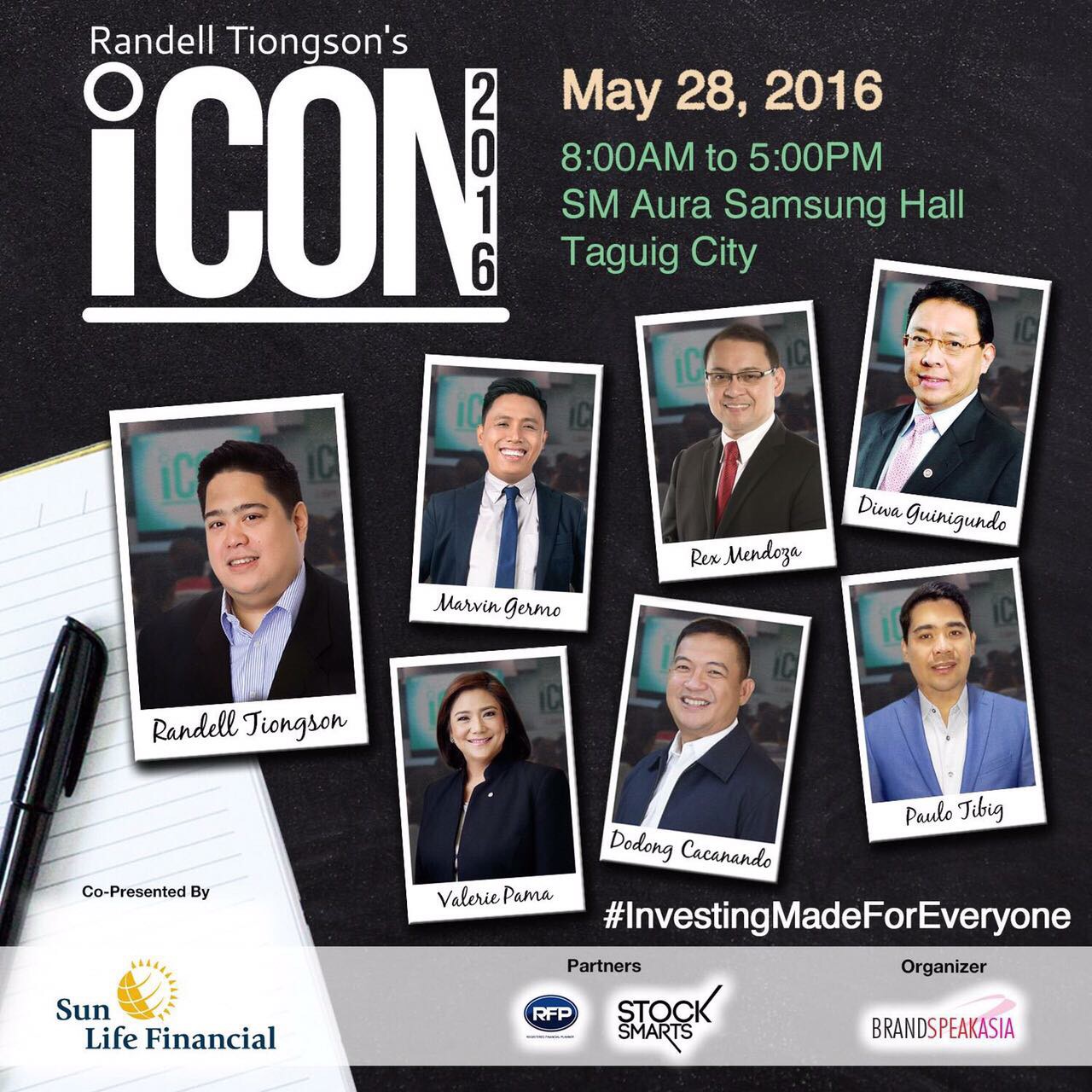

Learn practical and effective investment strategies from the biggest investment conference of the year iCon2016! We have assembled an impressive roster of experts for this year’s conference with Rex Mendoza of Rampver Financials, stock market advocate Marvin Germo, BSP Deputy Governor Diwa Guinigundo, Agri investor and business speaker Dodong Cacanando, entrepreneurship advocate Paulo Tibig, Sun Life Asset Management President Riena Pama and yours truly. May 28, 2016 at the Samsung Hall of SM Aura. Visit www.iCon2016.info for details and registration.