Pinoys and financial literacy

By Randell Tiongson on July 2nd, 2013 I was given a recent study commissioned by the insurer Sun Life Philippines on financial literacy.

I was given a recent study commissioned by the insurer Sun Life Philippines on financial literacy.

The study was both encouraging and disturbing at the same time. Encouraging because it seems that many Pinoys are getting better at handling their finances and disturbing because the study shows we are so far from being financially able.

The study validate many of the things me and my co-advocates have been harping about — poor habits, lack of information and mindsets to be broken. The study is pretty extensive and here are some of the highlights that I found important:

1) Filipinos are generally confident about how they handle their finances with 20% claiming to be an expert — and yet, only 8% who took the financial literacy quiz actually passed.

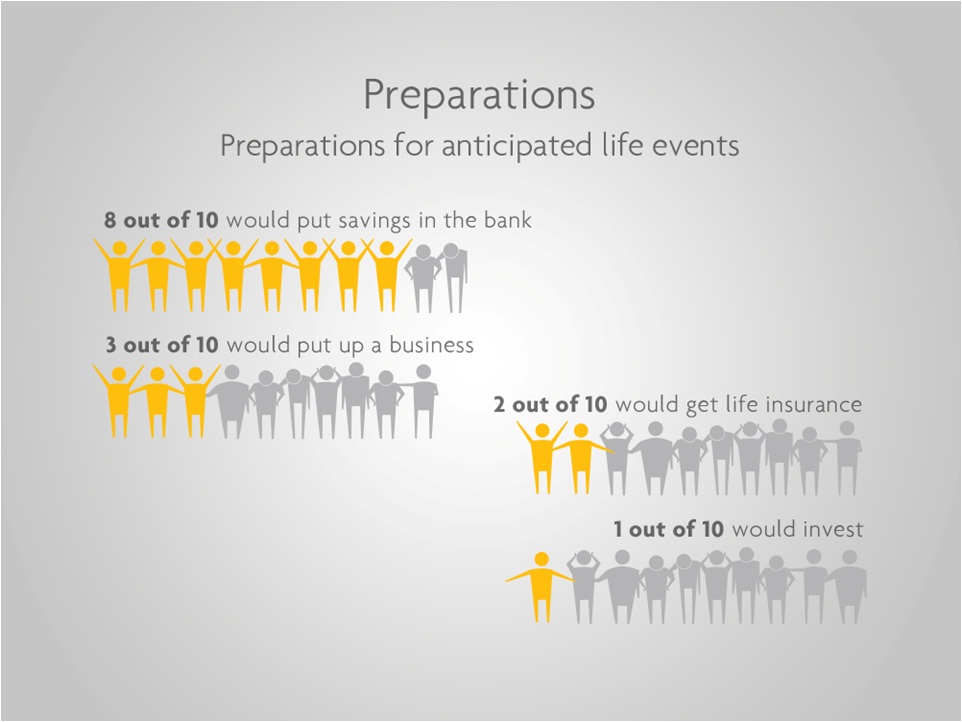

2) To prepare for anticipated life events, only 1 out of 10 Pinoys said he will invest.

3) 33% of Pinoys worry about their kid’s education; 20% on Food & 17% on family’s health.

4) Filipinos define financial security as “having enough bank savings.”

5) Among Pinoys top priority in the next 2 year – 37% said “Gadgets”!

6) 7 out of 10 Pinoys believe that everyone needs life insurance and yet insurance penetration in RP is only 1.14%

The reports indicated more results and I encourage everyone to get a copy of their report. It’s called SOLAR FLARe or the Financial Literacy Report.

———

Sun Life Press Release

Sun Life pioneers study on financial literacy

The Filipinos are an optimistic race. Amidst the recent stock market dip, there is widespread confidence about the country’s economic outlook. But are Filipinos prepared to face fluctuations and seize opportunities? Are they ready for the Brighter Life?

For the past five years, Sun Life has been conducting a nationwide Study of Lifestyles, Attitudes and Relationships (SOLAR) to gain insights on the public’s attitudes and behavior toward financial matters. This research has been instrumental in helping Sun Life pursue its thrust to raise financial literacy among Filipinos.

Uncovering a Paradox

Conducted during the first quarter of 2013 with 1,100 respondents coming from middle to upper income segments, the findings of this year’s SOLAR have been compiled in an account titled SOLAR FLARe or the Financial Literacy Report. Here, Sun Life discovered that Filipinos are confident about how they manage their finances, with 20% claiming to be an expert. However, test scores from a basic financial literacy quiz revealed a need for them to be educated further as only 8% scored above 80% and no one scored over 90%.

The report also looked into the priorities of Filipinos. When asked how they are preparing for these milestones, 8 out of 10 would rely on bank savings, overlooking other options such as life insurance and investments.

“While SOLAR FLARe reveals a lack of knowledge of some financial concepts, it does indicate an improving attitude towards life insurance. Life insurance is now considered by a third of the respondents as a priority purchase for the next two years,” said Sun Life Philippines President and Chief Executive Officer Riza Mantaring.

Advocating Financial Literacy

SOLAR FLARe upholds Sun Life’s tradition of understanding Filipinos and teaching them how to achieve lifetime financial security. It will be noted that Sun Life launched “It’s Time!” in 2009, the first multi-media financial literacy advocacy in the country, meant to educate Filipinos on financial preparedness.

During the official presentation of Sun Life’s report to the Insurance Commission, Mantaring expressed Sun Life’s desire to strengthen the partnership between public and private sectors in widening the reach of financial education.

“We want to reach out to all players in the insurance sector, like other financial services companies and the Insurance Commission, to unite in our noble mission of securing the future. Filipinos do need to know more about growing and securing their money, and this inspires us in Sun Life to continue and further expand our financial literacy advocacy,” affirmed Mantaring.

Thank you for sharing these statistics Sir Randell.

I hope more and more Filipinos strive hard to become financial literate (not just knowing the concepts but also applying them). I talked to a lot of people (mostly close friends and colleagues) who wants to create their emergency fund, buy an insurance, stop taking too much loan and invest for their future but failed to start. Some of them “wished” to have this things but never dared to increase their income or decrease their lifestyle. Sigh.

But I know there’s still hope… 🙂

SOLAR FLARe upholds Sun Life’s tradition of understanding Filipinos and teaching them how to achieve lifetime financial security. It will be noted that Sun Life launched “It’s Time!” in 2009, the first multi-media financial literacy advocacy in the country, meant to educate Filipinos on financial preparedness.

Sun Life of Canada (Philippines) Inc., recently introduced “It’s Time” campaign, a financial literacy program that will change the mindset of Filipinos when it comes to saving and investing for the future.

“5) Among Pinoys top priority in the next 2 year – 37% said “Gadgets”!”

I would prefer getting another MF account or add more savings.