Investing in good and bad times

By Randell Tiongson on November 20th, 2014To a great degree, investments are generally affected by economic cycles. You always hear people encouraging you to make investments because the economy is good. You also hear businessmen complain a lot when the economy is bad. The economy goes through changes from time to time which we normally refer to as economic cycles.

Economic cycles are fluctuations in the economy between periods of expansion or growth and contraction or recession. Factors that determine cycles are usually Gross Domestic Product (GDP), interest rates, employment numbers, consumer spending and the like. Investopedia further explains: “An economy is deemed to be in the expansion stage of the economic cycle when gross domestic product (GDP) is rapidly increasing. During times of expansion, investors seek to purchase companies in technology, capital goods and basic energy. During times of contraction, investors will look to purchase companies such as utilities, financials and healthcare.”

People are more likely to invest their money during when the economy is in its growth cycle and they are likely to stay away from investing when the economy contracts. What should be the right investment approach during the economic cycles? Should you stop investing when the economy is down and invest when it’s growing?

Economist and finance advocate Dr. Alvin Ang’s position is as follows:

“My take on business cycles is that they are closely related to productivity growth. Sustained growth of productivity usually predicts expansion. The investment strategy during this phase should be aggressive commensurate to the growth of productivity. It’s a time for accumulation as household capacities are expanding as well. During slowdown of productivity growth, leading to Decline, investment strategy should mimic the rate of productivity slowdown. During recession productivity falls sharply. Investment becomes least priority but the strategy is to continue with an established base amount at least 10% of the rate invested at aggressive phase. This should go up commensurate to the rate of recovery.”

Seasoned stock market investors, especially the more aggressive ones like Marvin Germo may take a contrarian approach when it comes to investing in economic cycles. Stock prices usually would go down prior to any economic decline so they will start to stay away from the market even if the economy is still not yet at a decline. The stock market will usually be at it’s lowest during a recession which is a signal to investors to start accumulating good quality stocks at a bargain. I once heard a stock market expert say to ‘start selling stocks at the sound of bells and start buying at the sound of alarms’; in other words, buy when people are afraid to buy and sell when people have been buying like crazy. This approach is typical of many who have a trading strategy. Recessions to them are opportunities to make a killing in the market. Interestingly enough, many of SM’s major investments were also done during bad economic times (SM North EDSA, Mega Mall, etc.) since cost of land, labor, etc. are much cheaper. In 2013, the economy was doing really well, and yet there was a big correction in our local markets. In the short term, prices may not always be a true representation of real value. The chart below shows the performance of the PSEi in 2013:

Other investments such as fixed income are also economy sensitive but not as anticipatory like stocks. When the economy is in a decline, prices of bonds normally go down and with that, yields of bonds will go up as a result. Although not as volatile as stocks, capital losses can also be experienced if you have a short-term orientation.

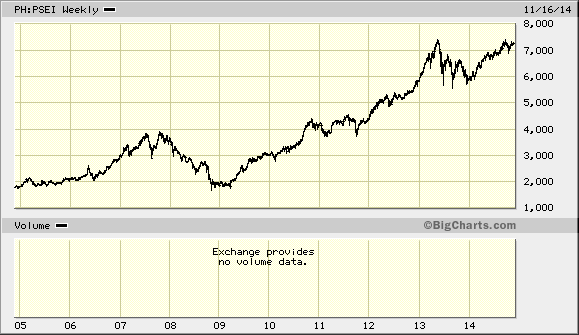

If you are a long-term investor and you are investing according to long-term objectives such as retirement, education funding, etc., cycles should not have an adverse effect on you. In a longer period, say 10 years and while markets will go up and down, and even experience crashes such as the 2008 crash, it is expected that markets will recover and will still go up despite volatility. For long-term investors, the issue is not so much on volatility but really on time. I often remind people that stock market investing is not just about timing, it is also about time. The general rule in investing is this: the longer, the better. The chart below shows the PSEi in a 10-year period. You can see that the market, though very volatile is on an upward trajectory in the long term:

Fixed income investments (Bonds) will not have any capital loss and yields will be realized if it is held up to its maturity. Just like stocks, bonds will do well in a long period, with less volatility.

When investing, it is very important to determine your investment objectives and time frame first. It is generally a good idea to hold on to your investments up until the time you need it and if your horizon is rather long, say 10 years, you should not be too nervous every time you hear negative news about the economy. A properly diversified investment strategy should allow you to hit your objectives even with the different economic cycles if you in the long run. Opportunities are also there for the taking when economy goes down, as long you are patient enough to wait when the economy rebounds and you have the appetite to take risks.

But alas, always remember that money and investments are just tools and they are not the end goal. In God’s economy, there are no recessions.

“But lay up for yourselves treasures in heaven, where neither moth nor rust destroys and where thieves do not break in and steal.” – Matthew 6:20, ESV

Learn more investment strategies at the Money Manifesto Conference. To register, CLICK HERE.

Hi Sir Randell,

For me “Investing in good and bad times” is like practicing cost averaging when investing.

More sUccess,

Red @ NewSmile – Batangas City Dental Clinic

Thanks Randell for this great post!

It’s something stock investor should really keep in mind. It’s tough to be contrarian, but it can be very profitable.